**ICP Price Bounce Fueled by Short Liquidations and Volume Surge**

Short liquidations at the $3.55 level sparked a significant bounce in the price of Internet Computer (ICP), attracting buyers and driving a 6.5% increase. This upward move was supported by high trading volumes, propelling ICP to reach $3.67. However, the price later dipped after encountering resistance near $3.75—a level that has held firm since mid-October.

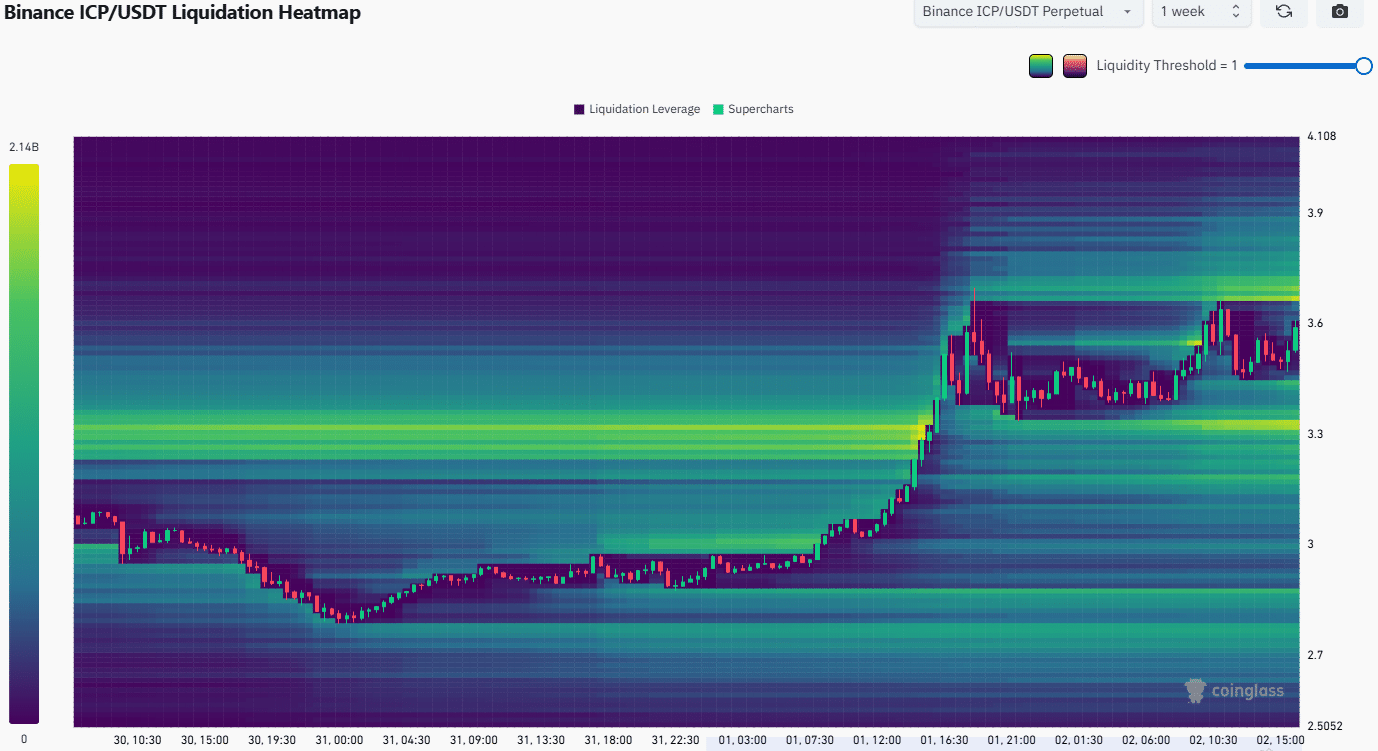

Over a 24-hour period, ICP experienced a liquidity build-up that contributed to the surge. Data shows that the $3.75 supply zone continues to act as a key resistance barrier for the token.

—

### What Fueled the ICP Price Bounce?

The ICP price bounce was primarily triggered by a cluster of short liquidations around the $3.55 level. These liquidations generated substantial buying pressure, lifting ICP’s value by 6.5% within 24 hours, rising from $3.33 on November 1st to a peak of $3.67.

Increased trading activity following the dip played a crucial role in amplifying this movement. Despite the rally, the price faced stiff resistance at the $3.75 supply zone, which has been well-established since mid-October.

—

### What Could Indicate ICP’s Next Moves?

Market data from CoinGlass highlights a notable liquidity cluster at $3.55 that attracted buyers on November 2nd, driving the price upward. Prior to this, prices dipped to $3.33 before stabilizing near $3.50 for almost a day. This consolidation phase built up short positions, whose liquidation fueled the subsequent surge.

Assets in similar scenarios often gravitate toward high-liquidity zones. For ICP, the next significant resistance lies between $3.70 and $3.75, where gains may be capped unless momentum shifts.

Trading volumes spiked during this upward movement; however, without a change in the broader trend, this bounce may be a temporary correction rather than a sustainable reversal. Analysts emphasize that liquidity-driven rallies require confirmation from higher timeframes to validate a sustained breakout.

Historical price action shows that ICP’s resilience is frequently tested by persistent supply pressures. Notably, on November 1st, the $3.33 level acted as a supportive floor before the rebound unfolded.

—

### Frequently Asked Questions

**Why did ICP experience a sudden 6.5% price increase on November 2nd?**

The rally was triggered by accumulated short liquidations near $3.55, sparking upward momentum amid rising trading volumes. This followed a consolidation period around $3.50 and culminated in a peak at $3.67 before a minor pullback.

**Is the ICP price bounce a sign of a broader recovery in the cryptocurrency market?**

While the bounce indicates short-term buying interest driven by liquidations, it does not confirm a broader market recovery. ICP’s weekly charts show a persistent downtrend dating back to March. This trend has remained intact despite earlier Bitcoin rallies in April and June. Traders should watch for sustained breaks above critical resistance levels before considering a trend reversal.

—

### Resistance Challenges and Long-Term Strategy

The $3.75 to $3.78 zone remains a key resistance barrier for ICP. Bearish technical indicators, such as negative readings on the Chaikin Money Flow (CMF) and the Awesome Oscillator, continue to exert downward pressure.

To confirm a bullish turnaround, investors should watch for a decisive break above $3.80 with a successful retest of that level as support. Until such confirmation, the downtrend that began in March remains the dominant market structure.

—

### Conclusion

The recent ICP price bounce illustrates how clusters of liquidity can trigger short-term rallies in volatile cryptocurrency markets. However, the token’s broader trajectory is still shaped by a bearish weekly pattern that has persisted since March.

As ICP tests supply zones near $3.75, investors are advised to rely on data from reliable analytics tools to make informed trading decisions. Monitoring shifts in momentum will be key to identifying strategic opportunities in the evolving landscape of Internet Computer.

—

*Disclaimer: The information presented in this article is for informational purposes only and does not constitute financial, investment, or trading advice.*

https://bitcoinethereumnews.com/tech/icps-short-term-bounce-hits-3-67-on-liquidations-but-long-term-downtrend-persists/?utm_source=rss&utm_medium=rss&utm_campaign=icps-short-term-bounce-hits-3-67-on-liquidations-but-long-term-downtrend-persists