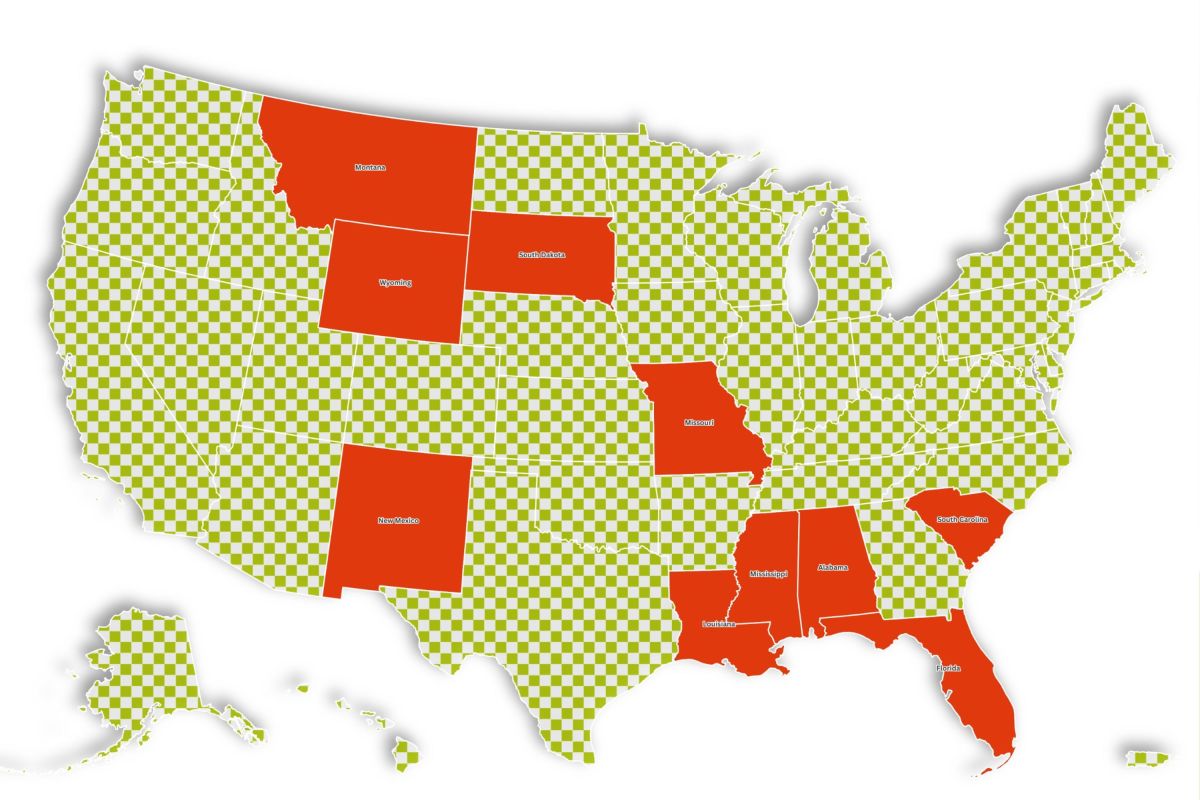

Mississippi has been ranked as the deadliest state for driving during the Thanksgiving holiday, according to a new study. Thanksgiving is not only one of the busiest travel periods of the year in the United States, but it can also be one of the most dangerous. New analysis by researchers at the personal injury law firm Andrew Pickett Law looked at fatal crash data from the National Highway Traffic Safety Administration (NHTSA) from 2014 to 2023. It determined which states had the highest number of deaths per capita during the Thanksgiving holiday period. According to the study, Mississippi tops the list as the most lethal state for Thanksgiving driving, recording 33. 77 deaths per 1 million residents during the decade-long review. That figure is 127 percent higher than the national average of 14. 88 fatalities per million. Southern states dominated the highest rankings. Alabama came in second place, with 25. 87 deaths per 1 million residents, a rate that is 74 percent higher than the U. S. national average. South Carolina followed closely in third place, with 25. 59 fatalities per 1 million, or 72 percent above the national average. Louisiana came fourth, recording 25. 12 deaths per 1 million residents, which is 68. 84 percent higher than the average. South Dakota rounds out the top five, with 24. 81 fatalities per 1 million residents, 66. 78 percent higher than the national rate. “With millions of Americans on the road this holiday season, it’s more important than ever to prioritize safety,” Andrew Pickett, founder of the Florida-based firm, said in a statement on the study. “Simple steps like slowing down, staying alert, avoiding distractions, and never driving under the influence can make a real difference in preventing accidents and ensuring everyone gets home safely for Thanksgiving.” According to the American Automobile Association (AAA), at least 73 million people are expected to travel by car during the Thanksgiving travel period from November 25 to December 1. That’s nearly 90 percent of all Thanksgiving travelers, and 1. 3 million more than last year. The figure could climb even higher if some air travelers opt to drive due to flight cancellations. Last year, AAA responded to nearly 600, 000 emergency roadside calls over the Thanksgiving period, helping stranded drivers with dead batteries, flat tires, and empty fuel tanks. According to the AAA, the NHTSA reports that 868 people were killed in drunk-driving crashes during Thanksgiving celebrations from 2019 to 2023, accounting for 35 percent of all traffic fatalities over that period.

https://www.newsweek.com/mapped-americas-deadliest-states-driving-thanksgiving-travel-11100405

All posts by admin

Why BlockchainFX ($BFX) Is Emerging as One of the Best Cryptos Under $1 This Season

Crypto Presales Sometimes an opportunity in the market arrives that feels timed perfectly with what traders have been waiting for. It might begin with a simple question such as what if a single platform finally connected traditional finance with crypto in a way that worked for everyone. It is this type of practical problem solving that often sparks the next major wave of adoption. Across the market, several new presales have started gaining attention as investors explore early entries before the next market rotation. Projects like Remittix, Bitcoin Hyper, Snorter Token, Best Wallet Token, and Little Pepe are actively expanding their communities with new features and ambitious goals. Activity is increasing across multiple sectors, signaling a rising appetite for strong presale opportunities among both retail and mid-size investors. At the center of this rising momentum is BlockchainFX (FX). The project has become one of the strongest contenders among the top crypto presales, best cryptos under $1, and best cryptos to buy in November due to its powerful trading infrastructure, expanding real-world utilities, and exceptional presale performance. This article will cover the developments and updates for BlockchainFX (FX), Remittix, Bitcoin Hyper, Snorter Token, Best Wallet Token, and Little Pepe. 1. BlockchainFX (FX): A Standout Performer Among the Best Crypto Presales Today BlockchainFX (FX) continues to gain traction globally and has already attracted more than 18, 475 participants. The presale has raised 11, 495, 541. 44 dollars, completing 95. 79 percent of its 12 million dollar softcap, presenting a strong signal of investor confidence. The project delivers practical solutions to long-standing inefficiencies in trading while giving holders ways to earn daily rewards from platform activity. Below are the core value points that define BlockchainFX as one of the most promising entries among the best crypto presales under 1 dollar. Unified Global Trading Hub for 500+ Assets BlockchainFX brings together crypto, forex, stocks, commodities, ETFs, futures, options, and bonds inside one platform. Investors are able to move between more than 500 assets without repeatedly changing brokers, blockchains, or applications. This integrated model solves a real problem in modern trading where users often need multiple accounts just to access basic markets. A unified trading hub simplifies execution and gives traders more control during volatile market events. Dual Rewards in BFX and USDT One of the strongest features driving attention is the platform’s reward distribution model. Holders earn daily rewards in both BFX and USDT which come from as much as 70 percent of all trading fees that the platform redistributes to its community. This dual income flow creates consistent earning potential, even for people who prefer a passive approach rather than active trading. The reward system is structured to benefit long term holders and contributes to a strong foundation for ecosystem loyalty. BlockchainFX Visa Card for Global Spending The BlockchainFX Visa Card is a major advancement for real world usability. It links directly to user trading accounts and allows spending in stores, online, and across international locations. Users gain instant access to profits, receive cashback style incentives, and avoid complicated conversion processes. The card positions BlockchainFX not only as a trading ecosystem but also as a lifestyle oriented brand that fits into everyday financial activities. BF70 Bonus: The Most Aggressive Token Offer Released So Far The BF70 bonus code provides a significant advantage for new buyers with an additional 70 percent in tokens. The market may be experiencing temporary corrections, but this environment often provides ideal opportunities for strategic entries at lower cost. With the BF70 incentive, participants receive a considerably larger position before listing, enhancing long term upside potential. It stands out as one of the most impactful presale incentives currently available. One Thousand Dollar Investment Scenario Using BF70 The presale price remains at 0. 03 dollars. One thousand dollars divided by the presale price gives 33, 333. 33 BFX tokens. The BF70 bonus adds 70 percent which equals 23, 333. 33 additional tokens. The total becomes 56, 666. 66 BFX tokens. At the 0. 05 dollar listing price, the position would be valued at 2, 833. 33 dollars. This reflects a potential gain of approximately 183 percent before factoring in future platform growth or daily reward distributions. Presale Structure and Long Term Framework BlockchainFX operates on Ethereum with a total supply of 3. 5 billion tokens and a target listing price of 0. 05 dollars. The current presale stage maintains a 0. 03 dollar token price while surpassing 11. 4 million dollars in commitments. Early entrants benefit from a sizable advantage before public liquidity opens. Any unsold tokens will be burned and liquidity will be locked after launch which increases transparency and strengthens market trust. 2. Remittix Remittix focuses on enhancing global payments with blockchain backed transfers. The project aims to improve cross border transactions through speed, lower fees, and improved accessibility. Its presale has attracted interest from users in regions where remittance costs traditionally reduce earnings, making the token appealing for practical day to day use. 3. Bitcoin Hyper Bitcoin Hyper combines high speed blockchain performance with familiar Bitcoin styled branding. The project emphasizes faster confirmations, higher throughput, and a more responsive architecture for individuals who enjoy the Bitcoin narrative but want enhanced technical capabilities. Its presale has been gaining interest from performance focused investors. 4. Snorter Token Snorter Token blends entertainment, trading incentives, and community centric features into one ecosystem. The token captures attention through humor driven branding while offering tools and activities that keep the community engaged. Its presale benefits from strong participation among newcomers and meme friendly audiences. 5. Best Wallet Token Best Wallet Token supports a multi purpose crypto wallet designed for tracking, storing, swapping, and staking assets. The token serves as a gateway to premium wallet utilities and ecosystem benefits. Early buyers see potential in the platform’s integration of both DeFi tools and traditional portfolio management functions. 6. Little Pepe Little Pepe delivers a community first meme token experience with added features such as controlled burning events to increase scarcity. Strong community activity and consistent updates have helped the project develop momentum during its presale phase. Why Early Participation in the BFX Presale Presents Strong Strategic Value BlockchainFX offers real utility from the moment users enter the ecosystem. The ability to trade across global financial markets, earn daily rewards in two assets, and spend through a dedicated Visa card positions the project ahead of many presales that are still in conceptual stages. The presale structure, combined with the BF70 bonus, gives early supporters significant growth potential and practical value at the same time. Where many presales rely solely on branding or speculation, BlockchainFX delivers infrastructure that traders can use immediately. This blend of practicality and strong reward mechanics sets it apart within the current lineup of competitive presale options. BFX Listed As The Top Crypto Presale of 2025 All of the projects covered here contribute to the growing enthusiasm surrounding the best crypto presales and best cryptos under 1 dollar. Each brings its own direction and potential based on utility, community strength, or innovative concepts. However, BlockchainFX stands in a unique category due to its multi asset trading environment, daily dual reward system, Visa card utility, and one of the highest performing presales currently active. With momentum continuing across its investor base and strong incentives like the BF70 bonus, BlockchainFX presents a compelling early stage opportunity for buyers seeking strong long term value and continuous ecosystem benefits. For More Information: Website: X: Telegram Chat: This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own researchs. Author Krasimir Rusev is a journalist with many years of experience in covering cryptocurrencies and financial markets. He specializes in analysis, news, and forecasts for digital assets, providing readers with in-depth and reliable information on the latest market trends. His expertise and professionalism make him a valuable source of information for investors, traders, and anyone who follows the dynamics of the crypto world. Related stories.

https://bitcoinethereumnews.com/finance/why-blockchainfx-bfx-is-emerging-as-one-of-the-best-cryptos-under-1-this-season/

“How much stability are we going to give him?” – Dinesh Karthik’s massive statement on Team India after whitewash in IND vs SA 2025 Tests

Former batter Dinesh Karthik has hit out at the uncertainty surrounding India’s No. 3 position following their massive 408-run defeat in the second Test against South Africa in Guwahati. The match, which ended on Day 5 (Wednesday, November 26), saw India bowled out for just 140 in their second innings while chasing 549, marking India’s biggest Test defeat by runs as the hosts were whitewashed in the two-match series. Ad After the loss, Karthik, in a video posted on Instagram, questioned India’s constant chopping and changing at the No. 3 slot. Notably, seven different players have been tried in that position since September 2024. Karthik said: “In the World Test Championship cycle, out of the 65 Test matches that have been played, India’s No. 3 holds the 2nd worst record in the first innings of a Test match, averaging 26. That is something for us to ponder about. Who is our No. 3? How much stability are we going to give him? Washington plays at No. 3 in Calcutta. Sai Sudarshan is playing at No. 3 in Guwahati. Is chopping and changing helping Team India, or do we need to give more stability and consistency? What is the answer?” Ad Trending In the same video, Karthik also highlighted the lack of bowling opportunities given to all-rounder Nitish Kumar Reddy and added that India are a much better team than what they showed in the South Africa series, saying: “But what is lacking? Is it the quality of players? Their inability to play spin? Pacers and spinners being out bowled in India. One too many all-rounders being played. Nitish Reddy, the nominated all-rounder, pace all-rounder has bowled 14 overs across a whole domestic calendar season in Test cricket in India. India has just 2 players who have scored 100 runs in this Test series. South Africa had 7. I mean, come on, we are better than that for sure. How can suddenly there be a nose dive in Test cricket.” Ad This marked only South Africa’s second Test series win in India, with their first coming back in 2000 under Hansie Cronje. “Very minimal chances” Dinesh Karthik on India’s hopes for reaching 2027 WTC final In the same video, Dinesh Karthik stated that India have very slim chances of reaching the 2027 World Test Championship (WTC) final, saying: Ad “It almost feels like, in this World Test Championship cycle, India have very minimal chances. 2 away games against Sri Lanka, 2 away games against New Zealand, and 5 Tests against Australia at home. But the next Test match is after 7 months. Are we going to forget this? Are we just going to move on, saying, okay, that’s a fresh season? By then, so much of white-ball cricket would have happened, and I am sure India is so good at that. Will we tend to overlook what’s happening in Test cricket right now? That’s the big question for us to ponder. Think, what does it take for this Test team to come back and become as good as they were?” India are currently fifth in the 2025-27 WTC standings, with 48. 15 PCT after nine matches. × Feedback Why did you not like this content? Clickbait / Misleading Factually Incorrect Hateful or Abusive Baseless Opinion Too Many Ads Other Was this article helpful? Thank You for feedback Follow IPL Auction 2025 Live Updates, News & Biddings at Sportskeeda. Get the fastest updates on Mega-Auction and cricket news Edited by Dev Sharma.

https://www.sportskeeda.com/cricket/news-how-much-stability-going-give-him-dinesh-karthik-s-massive-statement-team-india-whitewash-ind-vs-sa-2025-tests

Wynwood Norte tower OK’d with four conditions

Written by John Charles Robbins on November 26, 2025 A new mixed-use residential tower is planned for the Wynwood Norte Neighborhood Revitalization District (NRD-2) in Miami. This story is premium content for our subscribers only. Unlock the full story and the entire edition with a Miami Today subscription!.

https://www.miamitodaynews.com/2025/11/26/wynwood-norte-tower-okd-with-four-conditions/

Cash App Taxes Review: Pros, Cons, And Alternatives

Quick Summary Filing is always free, regardless of tax situation Audit support is included No option to work with tax pros Pros Free tax filing (federal and state) Free audit support Intuitive user interface Cons Doesn’t handle underpayment penalty calculations Limited form imports No expert tax support available Cash App Taxes Details Product Name Cash App Taxes Federal Price $0 State Price $0 Preparation Type Self-Prepared Tax Software Promotions None If you’re looking for free online tax software, Cash App Taxes is one of the only services offering truly free federal and state filing to all users. It doesn’t charge a cent regardless of your filing situation. If Cash App Taxes supports your needs (which it does for most people), it’s free to use. While it doesn’t have all of the bells and whistles of the premium-priced TurboTax, it can handle the most common situations. Cash App Taxes made updates for the 2026 tax filing season (for 2025 income taxes) to keep up with changes to tax laws, tax brackets, and limits. If you’re considering doing your taxes online this year, which is the most cost-effective option for most households, follow along with this Cash App Taxes to learn everything you need to know about this no-cost platform. If you want to see how Cash App Taxes compares to other DIY tax prep options, check out our top tax software picks for 2026. Cash App Taxes Is It Really Free? Yes, Cash App Taxes is really free. Cash App Taxes is 100% free and doesn’t have any paid tiers, upsells, or upgrades. If Cash App Taxes supports your needs, which it does for most people, you won’t have to enter a credit card number or pay at any point in the process. Some tax filers, such as those who worked in multiple states or earned foreign income, may not be able to use Cash App Taxes. It also doesn’t support a limited number of states (Montana, New Hampshire, Tennessee, or Washington). The only catch, if you call it one, is that users have to download and sign up for Cash App. The app is actually quite helpful. It offers peer-to-peer money transfers similar to PayPal and Venmo. Block, Inc., the company behind the Square ecosystem of payment, payroll, and business products, owns Cash App and Cash App Taxes. Honestly, if you can use Cash App Taxes, you probably should. You can’t beat free tax filing! What’s New In 2026? Cash App Taxes made updates in 2026 to address tax law changes from Congress and IRS updates to limits, deductions, and brackets. The so-called ‘Big Beautiful Bill’ led to significant changes in taxes for health insurance, tipped employees, the standard deduction, small-business owner taxes, the State and Local Tax (SALT) deduction, and more. Cash App Taxes still doesn’t work for filers who need to file in multiple states, including if you moved to a new state mid-year or need to file a non-resident tax return. It doesn’t handle underpayment penalty calculations, which can be problematic for some filers, notably self-employed business owners and freelancers. While you can’t import investment data, you can import a W-2 if a qualifying partner payroll company handles your W-2. A couple of years ago, Cash App Taxes made significant design improvements, a nice refresh after its acquisition from Credit Karma (formerly Credit Karma Tax). Last year, we saw improvements in self-employment and independent contractor tax deductions and qualifying expenses. This is great for people who may have side hustled. Cash App Taxes is continuing its streak as our top choice for free tax filing. You can find the full rankings of the Best Tax Software here. Does Cash App Taxes Make Tax Filing Easy In 2026? Warning: You can’t use Cash App Taxes if you need to file in multiple states. If you moved during 2025, you can’t use Cash App Taxes to file your 2025 state tax returns. Cash App Taxes makes tax filing relatively easy for most users. It only supports some W-2 imports but has decent calculators and a good user interface. Cash App Taxes is a top choice if you mostly have information from employment, bank interest, passive investments, or a small business. However, active traders (crypto or stocks) must manually enter each trade, which is tedious and can lead to errors. It also doesn’t support those who live in two states, work across state lines, or have to file in two states for any other reason. We also noticed the product didn’t catch errors, such as over-contributions to self-employed 401(k) plans, which led to challenges for a member of our team in accurately entering and submitting their tax return. Cash App Taxes Features Cash App Taxes offers free tax filing for most people, but the software is more robust than its price tag implies. These are a few of the product’s best features. Completely Free Federal And State Filing Most online tax software offers a free tier that is incredibly limited, so most people are forced to upgrade to a paid tier. Not so with Cash App Taxes. It offers all of its features for free. Users only need to download the Cash App to access the robust software. It really is free. Customized Filing Experience Filers complete a short questionnaire at the start of the filing process. This streamlines the process so users don’t have to open or review information that isn’t relevant to them. Required Multi-Factor Authentication Cash App Taxes takes security very seriously. It requires users to use multi-factor authentication. A second form of authentication is a best practice that few other companies offer or require. You can use a code from a text message or email when logging in. Free Audit Support Cash App Taxes provides free Audit Support (through a third-party) to anyone who files with Cash App Taxes. The support includes organizing tax documents, writing to the IRS, and attending hearings associated with the audit. Cash App Taxes Drawbacks Cash App Taxes is suitable for the typical tax filing scenario but has a few drawbacks, especially for those seeking premium features. You can check the Cash App Support page to see which situations they don’t support. Limited Form Imports Cash App Taxes only supports limited W-2 imports. If your employer or its payroll provider supports the feature, you can download your income details right into Cash App taxes with a few clicks. Otherwise, you’ll have to type it in manually. That’s not a huge deal for a simple W-2, but it is a hassle for other tax forms. They don’t allow users to import 1099 forms from banks and brokerages. This may be a dealbreaker, especially for crypto or stock traders who don’t want to enter every transaction manually. Several years ago, when it was still Credit Karma Tax, I had a problem with the imports that resulted in an error on my tax return. Possible To Skip Or Overlook Certain Sections Cash App Taxes’ new navigation uses a customized menu. A short questionnaire streamlines the software, so users aren’t overwhelmed by irrelevant options. However, users must manually click into each section to enter their information. Users may accidentally skip certain sections if they don’t realize they apply to their tax filing. Cash App Taxes Pricing Plans Cash App Taxes offers free Federal and State filing. Users don’t have to pay for anything, including free Audit Defense. How Does Cash App Taxes Compare? Cash App Taxes is a surprisingly robust software, especially when it’s compared to bargain and mid-tier software. This year, Chime Taxes also launched a free tax software option that is very similar to Cash App Taxes. Here’s a quick look at how it compares to FreeTax USA, TaxAct, and TaxSlayer. Header Rating Stimulus Credit Free Free Free+ Classic+ Unemployment Income Free Free Deluxe+ Free+ Student Loan Interest Free Free Deluxe+ Free+ Import Last Year’s Taxes Free Free Free+ Classic+ Snap Pic of W2 N/A N/A Free+ Classic+ Multiple States Not supported $14. 99/state Not advertised Free+ Multiple W2s Free Free Free+ Classic+ Earned Income Tax Credit Free+ Free Free+ Classic+ Child Tax Credit Free Free Free+ Classic+ Dependent Care Deductions Free Free Deluxe+ Classic+ HSAs Free Free Deluxe+ Classic+ Retirement Contributions Free Free Free+ Classic+ Retirement Income (SS, Pension, etc.) Free Free Free+ Classic+ Interest Income Free Free Deluxe+ Classic+ Itemize Free Free Deluxe+ Classic+ Dividend Income Free Free Deluxe+ Classic+ Capital Gains Free Free Premier+ Classic+ Rental Income Free Free Premier+ Classic+ Self-Employment Income Free Free Self-Employed Premium+ Audit Support Free Deluxe ($7. 99) Not Offered Premium+ Support From Tax Pros N/A Pro Support ($29. 99) Xpert Help Upgrade Premium+ Small Business Owner (over $5k in expenses) Free Free Self-Employed Classic+ Free Tier Price $0 Fed & $0 State $0 Fed & $14. 99/State $0 Fed & $39. 99 State $0 Fed & $0 State Second Tier Price N/A Deluxe $7. 99 Fed & $14. 99/State Deluxe $29. 99 Fed & $39. 99/State Classic $34. 36 Fed & $39. 95/State Third Tier Price N/A Pro Support $39. 99 Fed & $14. 99/State Premier $49. 99 Fed & $39. 99/State Premium $50. 36 Fed & $39. 95/State Fourth Tier Price N/A N/A Self-Employed $69. 99 Fed & $39. 99/State Self-Employed $58. 36 Fed & $39. 95/State Cell How Do You Log In To Cash App Taxes? Cash App Taxes significantly improved access to its product last year. Users can simply file their taxes from their phone or computer at cash. app/taxes. You are required to create a Cash App account in order to use Cash App Taxes. Support Options When using completely free tax software, you should expect to make a few compromises. In the case of Cash App Taxes, one compromise is limited support options. Cash App does have a new dedicated Help Center for Cash App Taxes. But unlike premium tax software companies, you won’t be able to upgrade to tiers that include access to tax pros. If you have a technical problem with the app, you can call the company’s main customer service at 1-800-969-1940. But if you want the ability to ask tax-related questions to experts, you’ll likely want to choose a different tax software. Is It Safe And Secure? Using any tax software involves certain risks, but Cash App takes security more seriously than most tax companies. It leverages its experience as a banking/brokerage company to protect user information. To keep your data safe, use unique passwords for every site you use, particularly financial ones like your banking and tax apps. If you’re doing your taxes on a public WiFi network, investing in a VPN can better secure your information. Why Should You Trust Us? The College Investor team has spent years reviewing the top tax filing options and has personal experience with most of the tax software tools. I have been the lead tax software reviewer since 2022 and have compared most of the major companies in the marketplace. Our editor-in-chief, Robert Farrington, has been testing tax software tools since 2011 and has tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies, which you can find on our YouTube channel. We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test. How Was This Product Tested? In our original tests, we used Cash App Taxes to complete a real-life tax return that included W-2 income, self-employment income, rental property income, and investment income. We tried to enter all the data and use every available feature. We then compared the result to all the other products we’ve tested, as well as a tax return prepared by a tax professional. This year, we went back through and rechecked all the features we initially tested, as well as any new ones. We also validated the pricing options. Who Is This For And Is Cash App Taxes Worth It? Note: Cash App Taxes is the best option for free tax filing. If you’re an active stock trader or have a more complex return, paying for an alternative may be worthwhile. Cash App Taxes offers a free product that is more robust than most paid products on the market today. It doesn’t rival premium services (like TurboTax, H&R Block, and TaxSlayer), but it’s serviceable for most filers who don’t actively trade stocks or crypto. Given the ease of use, we’re recommending Cash App Taxes as a top free tax filing option for this year. If your situation qualifies for Cash App Taxes, use it to save on tax preparation costs. If you’re still not sure, check out our list of Cash App Taxes alternatives. Get started with Cash App Taxes here >> Cash App Taxes FAQs Let’s answer a few of the most common questions people ask about Cash App Taxes: Can Cash App Taxes help me file my crypto investments? If you traded one or two tokens, you might want to use Cash App Taxes to file your taxes. Figuring out the cost basis on these trades won’t be too difficult. However, active traders must manually enter dozens or hundreds of transactions. This is too time-consuming to be worthwhile. Active traders should consider TaxAct or TurboTax to reduce the time spent filing. Can Cash App Taxes help me with state filing in multiple states? No. Cash App Taxes can help you file your Federal taxes, but it does not support multi-state filing. Tax filers who filed in multiple states should consider an alternative software program, such as Free Tax USA. Do I have to pay if I have a side hustle? Cash App Taxes is free for all users, including self-employed business owners and side hustlers. Does Cash App Taxes offer refund advance loans? Cash App Taxes doesn’t offer refund-advance loans, but filers can get their returns up to six days earlier if they deposit into a Cash App account. This is an FDIC-insured account. Does Cash App Taxes offer any deals on refunds? Cash App Taxes doesn’t offer any deals or incentives associated with refunds.

https://thecollegeinvestor.com/39045/cash-app-taxes-review/

JD Vance’s Memoir on Addiction Becomes Drug Smuggling Tool in Ohio Prison: ‘Ironical!’ Internet Reacts

In a bizarre twist, US Vice President JD Vance’s bestselling memoir about the dangers of addiction has been used to smuggle drugs into an Ohio prison, prompting a wave of stunned and amused reactions online. What was meant to be a raw account of working-class struggle, family turmoil, and the grip of narcotics culture somehow became a delivery system for the very thing it warns against. And the irony, as the internet quickly noted, practically wrote itself. A Memoir About Addiction Turns Into Contraband According to reports, Federal authorities revealed that a copy of Vance’s 2016 memoir Hillbilly Elegy was sprayed with narcotics and mailed to an inmate at the Grafton Correctional Institution in 2019. The book was disguised as an Amazon package, part of a broader drug-trafficking scheme that has now led to a lengthy sentence for the man behind it. On 18 November, a federal judge handed 30-year-old Austin Siebert of Maumee an 11-year and 8-month prison term for preparing and mailing the drug-soaked memoir, along with a GRE handbook and a treated sheet of paper. His plan unravelled after investigators captured him in a recorded phone call with the inmate, discussing the shipment. In the call, when the inmate asked, ‘Is it Hillbilly?’ Siebert briefly blanked before remembering which book he had used a moment that now reads like dark comedy in hindsight. An Ironical Moment for Vance’s Memoir The bizarre element of the case is the stark contrast between Vance’s message and Siebert’s method. Hillbilly Elegy, which explores the destructive impact of narcotics on Vance’s family and community, became a symbol of the opioid crisis and its ripple effects. Meanwhile, that same book, drenched in chemicals, was now serving as an entry point for illegal substances behind bars. Online reactions quickly labelled the situation ‘ironic’ and ‘unreal,’ as users pointed out that few objects could be more unintentionally symbolic than a drug-saturated memoir on addiction. The Memoir That Became a Cultural Flashpoint Before becoming accidental contraband, Hillbilly Elegy had already lived many lives. After its 2016 release, the memoir made Vance a national figure. He first conceived the idea while studying at Yale Law School, grappling with why upward mobility felt so out of reach for many people from backgrounds like his. The book blended personal narrative with broader reflections on political and cultural change in working-class communities in Kentucky and Ohio. After Donald Trump’s 2016 victory, it became required reading for voters and commentators trying to decode the country’s shifting political identity. Ron Howard adapted it into a 2020 film, and the memoir returned to the top of Amazon’s charts when Trump announced Vance as his vice presidential candidate. This latest chapter adds a strange footnote to the book’s legacy. According to reports, court documents show that Siebert used multiple treated items, including the memoir, hoping to slip drugs into the prison system through pages soaked in narcotics. Hence, considering the available information, there has been no indication by the authorities that it was a deliberate choice by those involved in this activity. For now, it seems like it was an accidental moment that has turned into an interesting, ironic story.

https://www.ibtimes.co.uk/jd-vances-memoir-addiction-becomes-drug-smuggling-tool-ohio-prison-ironical-internet-reacts-1758171

Call for Art: “Not Afraid” Juried Exhibition at WWA

West Windsor Arts and Art Against Racism, (both 501(c)(3) organizations, invite artists to submit artwork for “Not Afraid,” a juried exhibition of work that empowers artists to explore the intersection of identity and culture. It is open to all artists 16 years of age and older. All art must be original and new to West Windsor Arts. The deadline to submit art is December 9. There is a $5 entry fee for each work of art; each artist may submit up to three works.

https://www.towntopics.com/2025/11/26/call-for-art-not-afraid-juried-exhibition-at-wwa/

U.S. Army secretary warned Ukraine of imminent defeat while pushing initial peace plan

NBC News ^ | Nov 25, 2025 | Dan De Luce, Courtney Kube and Abigail Williams Posted on by McGruff In a meeting with Ukrainian officials in Kyiv last week, U. S. Army Secretary Dan Driscoll delivered a grim assessment. Driscoll told his counterparts their troops faced a dire situation on the battlefield and would suffer an imminent defeat against Russian forces, two sources with knowledge of the matter told NBC News. The Russians were ramping up the scale and pace of their aerial attacks, and they had the ability to fight on indefinitely, Driscoll told them, according to the sources. The situation for Ukraine would only get worse over time, he continued, and it was better to negotiate a peace settlement now rather than end up in an even weaker position in the future. And there was more bad news. The U. S. delegation also said America’s defense industry could not keep supplying Ukraine with the weapons and air defenses at the rate needed to protect the country’s infrastructure and population, the sources said. (Excerpt) Read more at nbcnews. com . TOPICS: Foreign Affairs; Russia; Ukraine; War KEYWORDS: 1 posted on by McGruff Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by.

https://freerepublic.com/focus/f-news/4354667/posts

Analyst: This Is Exactly What I’m Preparing You for With XRP

Date: Written By: Follow TheCryptoBasic RP community. Notably, the XRP market now boasts four spot XRP ETFs, which contributed to the impressive inflows on Monday. Interestingly, this performance has only led to stronger speculations about how consistent ETF buying might impact XRP’s price trend. For context, Canary Capital led the ETF campaign with its product debut on Nov. 13, and three more XRP ETFs have since entered the market. Their early performance has encouraged these speculations, especially as investors expect additional issuers to launch competing funds. Advertisement For Monday, Nov. 24, Bitwise CEO Hunter Horsley confirmed that roughly $18,000,000 in fresh inflows entered its ETF product (XRP) in a single day, pushing total inflows to around $135,000,000 within the fund’s first three days. Four XRP ETFs Absorb 80M XRP Meanwhile, game developer and well-known XRP community member Chad Steingraber, who has persistently monitored all four products since they launched, presented data across all products. According to his data, on Monday, the Bitwise XRP ETF traded 1, 452, 944 shares worth $36,599,659. Franklin Templeton’s XRPZ recorded 965, 203 units valued at $23,666,777. Meanwhile, Canary Capital’s XRPC followed with 783, 825 shares totaling $18,772,608, while Grayscale’s GXRP traded 152, 566 units worth $6,717,480. Altogether, the four funds moved $85,756,524 in trading volume that day. Steingraber then discussed their Monday netflows. Specifically, Canary Capital added 3, 193, 377 XRP, Bitwise accumulated 7, 837, 631 XRP, Grayscale acquired 36, 088, 433 XRP, and Franklin Templeton secured 32, 040, 560 XRP. Their combined total reached 79, 160, 001 XRP in one day. This update marked the first day of inflow data for Grayscale’s GXRP and Franklin’s XRPZ. However, it represented the ninth trading day for Canary Capital’s XRPC and the fourth day for Bitwise’s XRP fund. In a follow-up post, Steingraber estimated how much these ETFs could absorb if they kept this pace. Notably, he projected 80, 000, 000 XRP per day, 400, 000, 000 XRP across a five-day week, 1, 600, 000, 000 XRP over a month, and 19, 200, 000, 000 XRP in a year. “This is What I’m Trying to Prepare You For” According to the market commentator, these numbers showed the scale of activity he had tried to prepare the XRP community for. “This is what I’m trying to prepare you for,” Steingraber said, referencing his consistency in tracking these ETFs’ performances. He pointed out that these 80 million XRP inflows from the four funds corresponded with an $85 million volume and predicted that the market would eventually see multiple days of billion-dollar volumes, which would be more than 10 times the current figures. Naturally, these could lead to higher inflows. However, while the funds may continue to attract steady inflows, keeping up 80 million XRP every day may be unrealistic. For instance, updated figures for Tuesday, Nov. 25, show that the four ETFs absorbed 16 million XRP worth $35. 41 million, lower than the 80 million figure. Notably, this total still looked strong but fell well short of the earlier projection. Nonetheless, some days could deliver inflows far above 80 million XRP, possibly balancing weaker sessions. However, no available data guarantees this pattern, leaving analysts to watch how ETF demand develops from here. DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses. Author Mark Brennan Mark Brennan has been active in the cryptocurrency sector since 2014. His love and passion for the nascent industry drove him to develop interest in writing about important developments and updates about cryptocurrencies and blockchain. Brennan, who holds a Masters degree in Business Administration, learned about the potential of blockchain technology. Aside from crypto journalism, Brennan runs an education center, where he educates people about the asset class. XRP Showing Signs of Recovery but Ichimoku Cloud Puts Resistance at Crucial Level XRP shows signs of recovery as momentum improves, but stiff resistance exists on the upper end of its daily Ichimoku Cloud. XRP is showing steady. Shiba Inu Remains Vulnerable Unless It Reclaims This Key Resistance Shiba Inu shows a mild rebound but remains vulnerable as key resistance levels cap the recent recovery push. Shiba Inu (SHIB) is showing a modest. U. S. PPI for September Rises 0. 3%: Here’s the Potential Impact on Bitcoin Bitcoin could respond favorably, as the latest U. S. Producer Price Index report for September shows a firmer rise in wholesale inflation. The PPI, which tracks. Is Bitcoin Entering Another 2022-Style Crash? Analyst Warns of Rising-Channel Breakdown The current Bitcoin pullback is closely tracking the same rising-channel breakdown pattern that preceded the 2022 downturn. Currently, Bitcoin trades at $86,301, down 0. 5% over. Here is the Level Ethereum Needs to Hold for a Surge Towards $3,300 Ethereum must hold key support levels to avoid further declines and potentially target higher resistance zones, amid recent institutional outflows. The latest Ethereum price chart. Ethereum Closes in on Bitcoin Annual Performance Following Strong Q3 Market data shows that Ethereum, the king altcoin, has dramatically closed in on Bitcoin’s annual performance following Q3 gains. Ethereum has nearly matched Bitcoin’s annual. Analyst RP Route to 2 Digit-Price With Elliott Wave Structure While XRP has faced resistance to its latest recovery effort, XForceGlobal believes it remains in an Elliott Wave structure that could push prices beyond. Millionaire Trader Says XRP to $8 Is Next Chapter, as Generational Wealth Journey Nears Its End A prominent trader has projected where XRP could head during its next leg up, suggesting that the generational wealth journey is close to an. Top Trader Says Shiba Inu Is Also Breaking Out Shiba Inu is attempting a reversal after several weeks of steady decline, with fresh momentum emerging on the charts. According to market analyst TraderSZ, SHIB. Shiba Inu Remains Vulnerable Unless It Reclaims This Key Resistance Shiba Inu shows a mild rebound but remains vulnerable as key resistance levels cap the recent recovery push. Shiba Inu (SHIB) is showing a modest. Expert Says Dogecoin Bullish Reversal Imminent as Grayscale DOGE ETF Goes Live An analysis suggests that the launch of the Dogecoin spot ETF in the US market would trigger a price recovery, potentially leading to new. Here is Resistance Dogecoin Must Reclaim to Surge Towards $0. 185 Dogecoin shows early signs of momentum recovery but must reclaim key resistance levels for further uptick. Dogecoin (DOGE) is showing a mild recovery after recent.

https://thecryptobasic.com/2025/11/26/analyst-this-is-exactly-what-im-preparing-you-for-with-xrp/

Junior Star Daniells Explodes for 6-Goal Weekend As PU Men’s Hockey Sweeps St. Lawrence, Clarkson

GOAL-ORIENTED: Princeton University men’s hockey player Kai Daniells (No. 7) goes after the puck in recent action. Junior forward Daniells came up big as the Tigers topped St. Lawrence 7-4 last Friday and then edged Clarkson 4-3 a day later. Daniells scored five goals in the win over St. Lawrence, matching the program’s single game record. He chipped in a goal and an assist in the victory over the Golden Knights. He was later named the ECAC Hockey Forward of the Week. The Tigers, now 5-2 overall and 2-2 ECACH, play a two-game set at Bowling Green on November 28 and 29. On Friday night, junior forward Daniells exploded for five goals to tie a program single-game record set by John Cook in 1962 to help Princeton pull away to a 7-4 win over visiting St. Lawrence. A night later, Daniells had the Hobey Baker Rink fans cheering again, tallying one goal and one assist as the Tigers overcame a 2-0 deficit to defeat Clarkson 4-3, improving to 5-2 overall and 2-2 ECAC Hockey. As Daniells hit the ice on Saturday, he was fired up to build on his record-setting performance. “I had a lot of excitement, a lot of confidence,” said Daniells, a 6’1, 185-pound native of Whistler, British Columbia, Canada. But it was Clarkson that played with confidence as it jumped out to a 2-0 lead in the first period. “It was definitely a slow start; Clarkson played good, they smothered us for the first 40 minutes,” said Daniells. With the Tigers trailing 2-1 heading into the third period, Daniells and his teammates were confident they could turn the tables on the Golden Knights. “We knew that was the best they had,” said Daniells. “Talking with my line in the intermission, we said if we stick to our game, we are too good to not break through. That is what we did ultimately and we were able to get the job done.” Daniells played a key role in helping the Tigers get the job done as he assisted in a goal by Kevin Anderson that knotted the game at 2-2 and then scored Princeton’s fourth goal which turned out to be the game winner. On his assist, Daniells stayed patient to set up Anderson. “It was part of our game plan to have the center low, I was in that spot and I got a nice little feed from Wanger (Brendan Wang) through the middle,” said Daniells. “The middle opened up so I found a nice spot there. My linemates were changing, I had a burst of energy there at the end of my shift and I chipped it in. I went to finish my hit and then next thing I knew the puck was there and I saw Kevin coming in late so I was able to hit him there. It was a great finish by him.” As for his goal, Daniells fought off a hit in the crease area to find the back of the net. “It was just a low battle we had been playing low all night,” said Daniells, who was later named the ECAC Hockey Forward of the Week. “I remember getting crunched on my shoulder and I was hoping I was OK. I snapped out of it and they kind of gave me a lane. I took it to the far side and I saw some daylight on the right side there so I was able to put it in.” The win over Clarkson marked the second straight night that the Tigers finished strong as they outscored St. Lawrence 4-1 in the third period on Friday and then had a 3-1 final 20 minutes on Saturday. “It is just sticking to our structure; we know that when we play our game, we are just as good as anyone in this conference,” said Daniells. “We have confidence in each other, we were building momentum the whole game. This is just a testament to our group.” Having overcome a shoulder injury that limited him to 17 games last winter, Daniells is gaining more and more confidence as the season goes on. “It was a long road for sure with a lot of uncertainty,” said Daniells, reflecting on his recovery. “I feel good. I was definitely a little scared on that one in the third but I was able to be fine. Stuff like that is a good confidence builder to know that you are alright and that I am able to play a much more physical game with or without the puck. I can lean on guys to protect it and to incorporate that into my game much more this year which is a great sign because that is the way I need to play. My shoulder is feeling a lot better. I am really happy.” Princeton head coach Ben Syer was happy with the physicality and savvy displayed by Daniells against Clarkson. “Everybody is going to talk about Kai Daniells and the goals that he scored and that’s great but he made two unbelievable plays,” said Syer. “He delayed the puck down in the offensive zone and let his linemates change and then go to work. That is why he got the hard hat tonight. It was not because he scored goals but doing that stuff that leads to momentum. We get a change, we get fresh bodies and we go to work.” The offensive production from Daniells this weekend certainly gave the Tigers momentum. “He has skill; he knows that, we know that,” said Syer. “When he plays hard, he is a different player. He earned those goals this weekend. He didn’t cheat the game. He played it the right way and set the tone for our entire group in the right way. Being healthy, that is certainly part of it. It is also a will and a determination too.” Princeton showed determination collectively against Clarkson with its third period outburst. “I am proud of them, they competed and didn’t quit,” said Syer. “They fought it for whatever it was for five, seven minutes in the first period. They stayed with it. They did it together and they bonded. They celebrated blocked shots. They celebrated good plays.” Syer is proud of the grit his players have displayed in producing their 5-2 start. “I am happy that the guys fought this weekend,” said Syer, whose team plays a two-game set at Bowling Green (5-4-3) on November 28 and 29. “We didn’t play as well as we needed to on the road, it was frustrating. We put ourselves behind the eight-ball. We came back and fought in league play. I am not looking at any type of record, I am just looking at the fact that we are grinding every game. Our league is hard and points are at a premium so to be able to get a few this weekend was nice.” Daniells, for his part, is looking forward to the weekend in Ohio. “It is going to be a crazy trip for us but we are excited,” said Daniells. “I have a couple of buddies on that team from back home so that will be exciting. We have some school time off, so we are excited to get out there and get on the road and play some hockey.”.

https://www.towntopics.com/2025/11/26/junior-star-daniells-explodes-for-6-goal-weekend-as-pu-mens-hockey-sweeps-st-lawrence-clarkson/