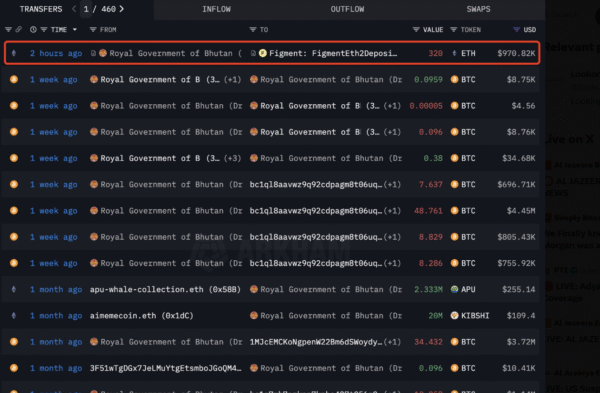

**Bhutan Moves 320 Ethereum to Figment, Deepening Its Digital Asset Strategy**

The Royal Government of Bhutan has taken a significant step in expanding its blockchain adoption by transferring 320 Ethereum (ETH), valued at approximately $970,000, to Figment, a leading institutional staking provider. This move highlights Bhutan’s ongoing commitment to integrating blockchain technology into its national systems and underscores its growing digital strategy.

**Institutional Ethereum Staking: Expanding Digital Horizons**

Figment specializes in providing institutional-grade staking services, offering secure and reliable blockchain participation. Bhutan’s decision to stake Ethereum through Figment is another milestone in its expanding blockchain journey, reflecting the nation’s trust in professional solutions to ensure security, compliance, and effective participation in the blockchain ecosystem.

**Migration of National Digital Identity to Ethereum**

In a broader context, Bhutan has recently started migrating its National Digital Identity (NDI) project to the Ethereum blockchain. This ambitious initiative aims to strengthen the self-sovereign identity of Bhutanese citizens by leveraging Ethereum’s decentralized infrastructure. According to data tracked by Onchain Lens and reported on November 27, 2025, the migration is expected to cover nearly 800,000 inhabitants and is on track to be completed by early 2026.

**A Broader Digital Finance Strategy**

Bhutan’s involvement with digital assets goes beyond Ethereum. The nation has previously added Bitcoin, BNB, and other digital currencies to its strategic reserves, particularly in connection with the pioneering Gelephu Mindfulness City (GMC) project. Bhutan is also known for mining Bitcoin using its abundant hydropower resources, reportedly holding as much as 6,371 BTC. Such efforts demonstrate a diversified and forward-thinking approach to digital economics.

**Gelephu Mindfulness City: Driving Digital Innovation**

The GMC project stands at the heart of Bhutan’s digital ambition. By integrating blockchain technologies, including Ethereum staking, into urban development and economic planning, GMC is positioned to become a hub for digital innovation in the Himalayan region. Acknowledging digital assets as part of strategic reserves within GMC signals Bhutan’s long-term commitment to blockchain and advanced technologies.

**Empowering Citizens through Blockchain**

The migration of Bhutan’s NDI system to Ethereum sets an important precedent, enabling citizens to have greater control over their personal data while enhancing privacy and security. By providing self-sovereign digital identity on a blockchain, Bhutan is empowering its people and establishing a model that other countries may follow as they pursue similar digital transformations.

**A Role Model for Blockchain Adoption**

Bhutan’s proactive embrace of blockchain technology, from digital identity management to crypto reserves and Ethereum staking, makes it a leader among developing nations. As a small country leveraging cutting-edge technology for national development, Bhutan serves as an inspiration for others seeking to integrate blockchain into governance and economic growth.

—

*Bhutan’s latest move into Ethereum staking reflects a larger global trend where nations are exploring blockchain for public services and innovation. As the world watches, Bhutan continues to demonstrate how digital assets and blockchain infrastructure can be harnessed for long-term national benefit.*

https://bitcoinethereumnews.com/ethereum/ethereum-news-bhutan-expands-blockchain-adoption-through-ethereum-staking/