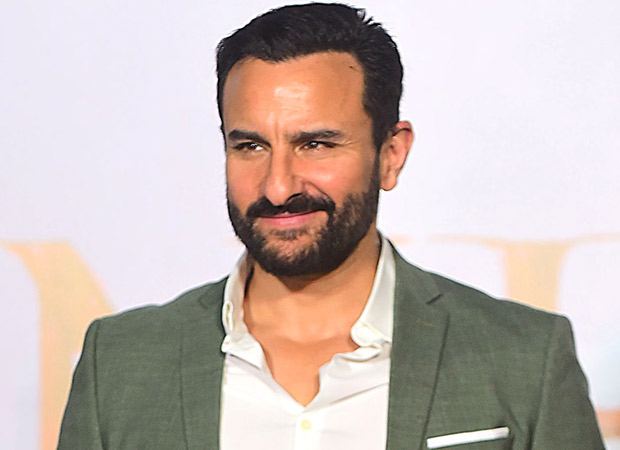

Bollywood actor Saif Ali Khan has added yet another prime asset to his real estate portfolio, this time in Mumbai’s thriving commercial district of Andheri East. According to property registration documents, the actor has purchased two office units in the Kanakia Wallstreet building for a total consideration of Rs. 30. 75 crore. Saif Ali Khan makes major real estate move; buys commercial offices worth Rs. 30. 75 crores in Mumbai The combined area of the newly acquired offices measures 5, 681 sq ft and includes six dedicated parking spaces. The seller of the property is Apiore Pharmaceutical, a US-based pharma company, as reflected in the registration filings. The deal was arranged by Volney, a real estate advisory and investor network firm. The transaction was officially registered on November 18, 2025, with a stamp duty of Rs. 1. 84 crore and a registration fee of Rs. 60, 000. Industry experts note that Andheri East has rapidly emerged as one of Mumbai’s busiest commercial corridors, attracting corporates, global enterprises, and creative firms due to its improved connectivity and infrastructure. Volney’s founder, Rohan Sheth, described the area as a market that combines accessibility with strong rental prospects, adding that it continues to draw long-term investors. Saif’s new commercial investment also places him among several high-profile names who have recently secured space in the vicinity. Elon Musk’s satellite internet company, Starlink Satellite Communications Private Limited, recently leased a 1, 294 sq. ft. office in the nearby Chandivali area for a five-year period, with total rent valued at Rs. 2. 33 crore. Additionally, the same building previously housed leased offices where Hrithik Roshan and Rakesh Roshan acquired three commercial units earlier this year for about Rs. 31 crores through HRX Digitech LLP. Beyond his latest acquisition, Saif Ali Khan is already known for his premium residential and commercial holdings across Mumbai. He currently resides in a high-end apartment in Bandra West, a property he purchased nearly a decade ago for Rs. 24 crores. Records also show that he bought a sprawling 6, 500 sq. ft. apartment in April 2012 for Rs. 23. 50 crore from Satguru Builders, further cementing his presence in the city’s luxury real estate landscape. With his latest investment, the actor continues to strengthen his position not just in cinema but also in Mumbai’s top-tier property market. Also Read: Dining with the Kapoors Trailer: Netflix brings together Bollywood’s first family for a grand tribute to Raj Kapoor BOLLYWOOD NEWS LIVE UPDATES.

https://www.bollywoodhungama.com/news/bollywood/saif-ali-khan-makes-major-real-estate-move-buys-commercial-offices-worth-rs-30-75-crores-mumbai/

Tag Archives: infrastructure

How Far Can RentStac Go? Analysts Suggest RNS Could Potentially Reach $1

Growing Interest Around the Presale Momentum around RentStac is increasing as the (RNS) presale advances through its early stages. In a market that’s shifting toward structured models tied to real economic flows, several analysts have started monitoring the project more closely. The goal is to understand how the model fits into the expanding RWA sector and what kind of growth potential it could show in the months ahead. Why Investors Are Turning Toward RWAs Real-world asset tokenization has become one of the standout trends of 2025. Investors are showing renewed interest in projects linked to physical assets, operational income and more predictable yield systems. This shift reflects a broader move away from purely speculative cycles. RentStac fits squarely within this movement by bridging real estate with blockchain infrastructure, offering a format that lowers the entry barrier to property-backed exposure. A Presale with a Clear Structure The RentStac presale is divided into seven phases with defined price increases. The total supply of RNS is two billion tokens, with forty percent allocated to the sale. The current phase lists the token at 0. 025 dollars, rising step-by-step to 0. 055 dollars in the final stage. If all seven phases reach full distribution, the total raise would exceed 27 million dollars. According to the project, presale tokens will be tradeable immediately at TGE with no lock-up. The platform also includes sections dedicated to operational updates and reward mechanisms, available on the official site. How the RentStac Model Works RentStac operates by tokenizing real-estate yield. Each property is placed inside a dedicated SPV, which manages rental income and operational flows separately from the rest of the system. These flows feed a dual-layer structure: a base yield reflecting property performance and an additional layer accessible through staking in property pools. This creates a direct link between real-world assets and token holders, while keeping the mechanics simple enough for users unfamiliar with traditional real estate. Security and Transparency Measures The project incorporates external smart-contract audits, multisig wallets and independent oracles to enhance transparency and protect user assets. SPVs legally isolate each property, while the roadmap outlines a gradual shift toward community governance, allowing token holders to vote on asset acquisitions and operational policies. These elements form part of the technical foundation analysts are evaluating as the presale progresses. Tokenomics and Utility RNS functions as a multi-utility token, enabling staking, access to property pools and future marketplace interactions. Token distribution spans the presale, treasury, liquidity reserves and development funds, aiming for a balanced structure that supports both utility and secondary-market stability. Analysts following the RWA sector note that this format aligns with the current demand for clearer and more sustainable token models. A Reference Based on Presale Progression The presale’s price progression already provides an internal reference for token valuation. RNS is priced at 0. 025 dollars in the opening phase, rising to 0. 055 dollars in the final stage. This built-in difference is one of the metrics analysts are tracking, as it highlights a notable nominal variation within the presale structure itself. Analysts Discuss Long-Term Scenarios In recent weeks, discussions among RWA analysts and sector commentators have included several long-term scenarios for projects similar to RentStac. Within these conversations, some have considered the possibility that, if the RWA market continues to expand and the project maintains consistent growth, the RNS token could approach the one-dollar mark over the span of a year. These are not official forecasts but rather exploratory models circulating within ongoing market analysis. What the Market Is Watching Now The growing attention around RentStac reflects the broader moment in the crypto sector, where investors are exploring alternatives grounded in real-world value. With its link to property-based income and a presale structure built on clarity, the project has emerged as one of the names regularly monitored in the expanding RWA category. As the presale continues and the market searches for equilibrium, RentStac is likely to remain on the radar of analysts observing the evolution of tokenized real-estate models. Learn more on the official website at rentstac. com.

https://bitcoinethereumnews.com/finance/how-far-can-rentstac-go-analysts-suggest-rns-could-potentially-reach-1/

Zelenskyy Heads To Turkey Amid Burgeoning Energy Sector Corruption Scandal

Ukraine’s president said he will head to Turkey for possible talks with the chief White House envoy involved in talks to end Russia’s nearly four-year-old war on Ukraine. Volodymyr Zelenskyy’s visit, planned for November 19, comes amid a series of international travels, including to France, where he secured a verbal agreement to acquire scores of French Rafale fighter jets. He was in Spain on November 18, and prior to that, Greece, where a deal on gas supplies was signed. “We are preparing to intensify negotiations, and we have worked out solutions that we will offer to partners. Bringing the end of the war closer with all our might is Ukraine’s first priority,” Zelenskyy said in a post to Telegram. News reports said Zelenskyy would meet with Steve Witkoff, the White House’s lead envoy for negotiations to try to end the Ukraine war. The Kremlin said no Russian officials would be present. No face-to-face talks have taken place between Kyiv and Moscow since the two sides met in Istanbul in July. Far-Reaching Corruption Scandal Zelenksyy’s travels coincide with a snowballing corruption scandal, which is shaping up as the worst political crisis he’s faced since his election in 2019. The scandal concerns allegations that funds earmarked for building defenses to protect Ukraine’s vulnerable energy infrastructure from Russian air attacks were siphoned off in the form of kickbacks to political insiders. The allegations burst into public last week when Ukraine’s two leading anti-corruption agencies published evidence detailing their findings. Among those implicated were Tymur Mindich, an old friend and former business partner of Zelenskyy. Mindich fled Ukraine for Poland on November 10 hours before authorities launched raids in connection with their investigation, law enforcement officials told Schemes, the investigative unit of RFE/RL’s Ukrainian Service. That prompted critics to allege he had been alerted ahead of the action. The revelations have already resulted in the resignations of the energy minister and the justice minister. Last week, the investigative agencies announced the arrest of a top official of a subsidiary of Energoatom, the state-owned nuclear company, on bribery allegations. And in June, a deputy prime minister, Oleksiy Chernyshov, was charged with corruption. Zelenskyy has not been implicated in the case. Energoatom said it was fully cooperating with the probe. Anti-Corruption Protests In Ukraine Over the summer, Zelenskyy sparked an uproar when he backed a measure that would have sharply reduced the independence of the two investigative agencies: Specialized Anti-Corruption Prosecutor’s Office and the National Anti-Corruption Bureau of Ukraine. After rare wartime street protests, Zelenskyy backed down. On November 18, a Ukrainian lawmaker alleged that the investigative records include a code-named person who is the head of Zelenskyy’s presidential office. The lawmaker, Yaroslav Zheleznyak, said the records showed Andriy Yermak allegedly directing unnamed officials to investigate officials with the National Anti-Corruption Bureau of Ukraine. Yermak did not immediately respond to requests for comment from RFE/RL’s Ukrainian Service.

https://www.rferl.org/a/ukraine-zelenskyy-energy-scandal-corruption-turkey-war-talks/33594741.html

CDL Token: Creditlink Integrates with Binance Wallet for Enhanced On-Chain Credit Accessibility to Global Web3 Users

**Creditlink (CDL) Integrates with Binance Wallet, Enhancing On-Chain Lending Accessibility**

Creditlink (CDL), a decentralized credit infrastructure that enables transparent lending and borrowing on-chain, has announced a key advancement in its network. According to today’s announcement, the Creditlink app — an on-chain credit marketplace — is now available on the Binance Wallet.

Creditlink operates as a decentralized identity verification and credit scoring system, leveraging AI algorithms to dynamically evaluate user creditworthiness. This innovative approach enables DeFi customers to access loans and borrowing services seamlessly on on-chain lending platforms.

—

### Addressing Barriers in DeFi Lending

Within the DeFi ecosystem, significant barriers still exist when it comes to accessing traditional financial (TradFi) services, especially borrowing without collateral. Powered by its native token (CDL), Creditlink tackles these challenges head-on by enabling users to access collateral-free loans and tailored Web3 financial services.

—

### Benefits of Integration with Binance Wallet

Starting today, the Creditlink app is fully integrated into the Binance Wallet. This integration incorporates CDL directly into the Binance Wallet, allowing users to efficiently access and manage the asset within their self-custody Web3 wallet.

This milestone offers the Creditlink community enhanced DeFi accessibility and utility. Binance Wallet, a secure non-custodial Web3 wallet, provides users with broad and simplified access to decentralized applications (dApps). Users can now perform instant swaps of CDL tokens with a wide variety of crypto assets straight from the wallet interface.

Furthermore, this integration significantly expands the accessibility of Creditlink’s on-chain credit platform, opening it up to millions of Binance users worldwide. The partnership empowers a larger global audience to engage with Creditlink’s ecosystem, driving wider adoption and application of the network.

—

### Unlocking New DeFi Lending Opportunities

By combining AI’s predictive capabilities with blockchain transparency, Creditlink remains dedicated to democratizing access to unsecured loans — bridging an essential gap between TradFi and DeFi landscapes.

The collaboration with Binance Wallet further solidifies Creditlink’s position as a leader in enabling unsecured lending and borrowing opportunities within the Web3 space.

—

Stay tuned as Creditlink continues to innovate and expand its offerings, making DeFi lending more accessible and inclusive for all users.

https://bitcoinethereumnews.com/tech/cdl-token-creditlink-integrates-with-binance-wallet-for-enhanced-on-chain-credit-accessibility-to-global-web3-users/

Top 5 Crypto Presales to Buy [X1000 Potential]

As crypto enters its next adoption cycle, a handful of early projects are building the foundations for what’s next — usable, scalable, and grounded in real-world logic. These five presales show where the next 1000x opportunities might emerge.

What used to be abstract code, tokens, and digital land is slowly becoming normal. The projects that define these moments aren’t the loudest ones; they’re the ones that build before attention arrives. They don’t need slogans. Instead, they focus on making systems that people can actually use, touch, and understand.

Crypto is moving from ideas to infrastructure. It’s no longer about buying something because it might grow; it’s about finding networks that already make sense. We’ve entered a phase where blockchain connects to things we use daily — games, identity, creativity, even ownership itself.

—

### 1. Tapzi (TAPZI)

One example is **Tapzi**, a Web3 gaming platform where skill, not speculation, drives progress. It doesn’t ask users to chase luck or yield; it rewards mastery and effort through fair, skill-based competition.

Tapzi reflects what this new market phase represents: a shift from invention to interpretation, from building hype to building systems that actually work. Real-world logic is returning to crypto.

Think about how the internet made communication effortless or how cloud storage replaced physical drives. Blockchain is now doing the same for ownership and interaction. That’s how change works.

The best projects aren’t trying to reinvent everything; they’re aligning blockchain with systems we already use. Every market cycle follows a rhythm: first comes excitement, then skepticism, then adoption.

We’ve seen it in music streaming, digital art, and electric vehicles. Crypto is at the adoption stage now where real products must justify their place.

It’s not about the next hype coin; it’s about networks that give users access, utility, and coordination. Tokens that make transactions faster, automate tasks, or simplify how we interact with digital spaces. These aren’t trends; they’re new layers of daily infrastructure.

—

### What’s Emerging Now: Clarity and Purpose

The next generation of tokens is designed with a clear purpose: usable worlds, transparent governance, scalable systems, and tools that remove friction.

These early projects don’t sell dreams; they solve problems. Whether through decentralized identity, AI-assisted contracts, or digital ownership models, they give blockchain a real function inside the economy that’s forming around it.

People often ask what makes a strong project in crypto. The answer isn’t in price charts; it’s in logic — a solid foundation, active utility, and a clear roadmap.

Each of these five early-stage crypto projects operates in a different domain from gaming to AI, but all share the same focus: structure, usability, and clarity. They are not just stories; they are systems taking form.

—

## The Five Promising Presale Projects

—

### TAPZI (Tapzi) — One-Tap Decentralized Automation

Most blockchain games focus on luck. Tapzi takes a smarter route by rewarding skill, not chance.

It’s a gaming platform on the BNB Smart Chain where players stake tokens to join matches of Chess, Checkers, Rock-Paper-Scissors, and other classics.

Every win earns tokens from a shared prize pool, creating a fair “skill-to-earn” model that actually values player ability.

The platform is designed to be simple and accessible. No complex setup or heavy downloads are required. Players can jump right in through their browser or mobile app, using TAPZI tokens to enter tournaments, upgrade in-game items, or stake for passive rewards.

With a total supply of five billion tokens and a fully transparent distribution model, Tapzi is built for long-term growth, not short-term hype.

Security and fairness are part of the foundation. All smart contracts are set to be audited by CertiK or SolidProof, and Tapzi’s ELO-based matchmaking system keeps competition balanced so every player, new or experienced, has a fair shot at winning.

**Key features:**

– Skill-based “play-to-earn” mechanics

– Cross-platform web and mobile access

– Audited contracts and a fair ranking system

– Fixed supply and clear token structure

– Roadmap toward NFT and multichain expansion

**Why it stands out:**

Tapzi blends gaming logic with real competition, proving that fun, fairness, and blockchain rewards can finally fit together in one system.

—

### ZADDY (Zaddy Coin) — Tokenized Social Influence

Every crypto cycle brings tokens that mix culture and utility in new ways. Zaddy Coin merges lifestyle, creativity, and decentralized finance into one connected ecosystem.

Built on the XRPL EVM for speed and low cost, and on Ethereum for liquidity, users can move easily between both chains without relying on wrapped assets.

The project is more than a meme; it’s an ecosystem. Users can mint digital collectibles, create memes through AI tools, and access DeFi services such as ZaddyFi’s token launch and real-world-asset modules.

There’s also a fashion and merchandise layer, turning the brand into something users can wear and trade.

Behind the scenes, a strategic reserve of XRP, ETH, and stablecoins supports liquidity and long-term sustainability.

**Why it matters:**

Zaddy Coin connects entertainment, identity, and finance under one brand. It brings purpose to meme culture while adding real functionality, making it one of the most dynamic early-phase crypto projects to follow this year.

—

### MASH (Monsta Mash) — Evolving Gaming Economy

Gaming is about skill, community, and progress, and Monsta Mash brings those core ideas to Web3.

It’s a world filled with cryptids and rare creatures that players can train, evolve, and deploy in battles or tournaments.

Every match, move, and victory earns players ASH tokens they can use for upgrades, skins, or trades within the game.

Built on Solana, Monsta Mash delivers smooth, fair gameplay with fast, low-cost transactions and transparent mechanics anyone can verify.

There’s even a Tap-to-Earn mode, designed for newcomers to jump in and start earning without complicated setups or large investments.

Additionally, the MashYields staking system lets holders stake tokens for steady rewards while participating in future updates and community events via DAO governance.

**Key features:**

– Play-to-Earn and Tap-to-Earn battles

– Solana-based speed and fairness

– Staking through MashYields

– Audited smart contract by SolidProof

– DAO input for community-led growth

**Why it stands out:**

Monsta Mash combines gaming energy with transparent blockchain design, creating a fair and engaging ecosystem where effort and play go hand in hand.

—

### BEST (Best Wallet) — Smarter Asset Management

Managing crypto should feel simple, not technical. Best Wallet builds on that idea by creating an all-in-one platform where users can hold, trade, and discover tokens seamlessly.

It brings together Best Wallet, Best DEX, and Best Card to form a connected ecosystem that covers storage, swapping, and real-world spending.

At its core, Best Wallet uses Fireblocks MPC-CMP security — a system trusted by major institutions — providing users self-custody without sacrificing safety.

It supports over 50 blockchains, integrates Rubic’s DEX aggregator for best swap rates, and includes a presale launch portal giving users early access to new tokens before exchange listings — a rare feature among wallets.

The EST token powers the ecosystem, reducing swap fees, unlocking staking rewards, and providing access to presales.

The roadmap includes a crypto debit card, NFT gallery, portfolio tools, and cross-chain interoperability.

**Why it stands out:**

Best Wallet isn’t just an app to store tokens; it’s a comprehensive ecosystem for Web3. By merging usability, institutional-level security, and presale access, EST positions itself as a practical and forward-thinking crypto launch this year.

—

### MAXI (Maxi Doge) — Meme Logic with Utility

Some tokens start as jokes. Maxi Doge begins as a challenge to outwork, out-trade, and outperform the market.

It’s a meme with muscle, combining humor with serious mechanics, driven by a community energized by both trading and gym culture: lift, trade, repeat.

The AXI token runs on Ethereum’s Proof-of-Stake network, secured by audited smart contracts from SolidProof and Coinsult.

Holders can stake for daily rewards through automated contract distribution, compete in trading contests, and join partner events integrated with futures platforms.

The Maxi Fund treasury fuels liquidity, partnerships, and marketing growth.

Its culture celebrates conviction and consistency — a space where traders share strategies, chase green candles, and motivate each other toward the next 1000x.

With a fixed supply of 150 billion tokens, transparent allocation, and an immediate Uniswap v3 listing after presale, the tokenomics feel grounded yet ambitious.

**Key features:**

– Staking rewards for holders

– Trading contests and community rankings

– Partnership-driven events

– Treasury fund for expansion

– Ethereum PoS efficiency

**Why it stands out:**

Maxi Doge turns community passion into a system of reward and rhythm, mixing culture, competition, and smart tokenomics to create an energetic and focused presale launch.

—

## Finding the Best Crypto to Buy Today

The crypto space is evolving. It’s no longer just about hype or chasing the next big thing.

The focus now is on projects that actually work — solving real problems, building tools people enjoy using, and creating communities that last.

What makes a token last isn’t how loudly it shouts, but how clearly it’s built, how strong its purpose is, and how well the team delivers.

That’s where Tapzi shines. It takes Web3 gaming and makes it feel real, fair, competitive, and fun.

Instead of relying on luck or flashy promises, Tapzi builds a space where skill and participation really matter.

It offers a clear view of where crypto is headed next: open, scalable, and focused on genuine engagement over empty speculation.

—

## What Is the Best Crypto to Buy?

Projects combining clear purpose, transparent development, and real-world structure stand out.

**Tapzi** is the best crypto to buy right now because it represents this shift perfectly. It ties gaming to fairness, skill, and participation in a way that’s logical and usable.

The goal isn’t speculation; it’s construction.

A best buy in 2025 is one with:

– Strong foundations

– A working model

– Evolving technology

– An engaged community

Tapzi checks all these boxes.

—

## Which Presale Projects Could Grow the Fastest?

Growth now depends on execution speed and structure.

Projects with functioning prototypes, planned DAO models, and multi-chain scalability are best positioned to move quickly.

Tapzi’s live gaming framework and structured “Skill-to-Earn” ecosystem show how fast expansion can happen when infrastructure is built before hype.

Similar presales with clear, phase-based development — not shortcuts — will be the fastest movers as markets stabilize.

—

## Why Are Utility and Structure So Important in Presales?

Utility ensures a token has a purpose beyond trading.

Structure ensures that purpose can scale effectively.

Together, they turn an idea into a product.

Tapzi proves this by linking skill, participation, and ownership through a transparent, player-driven ecosystem.

—

## Can These Presale Cryptos Shape the Next Wave of Web3?

Yes — especially the ones that connect technology to human logic.

The next wave of Web3 will emphasize connection, clarity, and control.

Through its fair, skill-based gaming design, Tapzi shows how digital systems can mirror real-world logic, where progress is earned, not bought, and every action has purpose.

—

As crypto moves forward, the projects that succeed will be those that build solid systems grounded in reality — and these five presale tokens illustrate the path ahead. Keep an eye on them as the next chapter of blockchain adoption unfolds.

https://bitcoinethereumnews.com/crypto/top-5-crypto-presales-to-buy-x1000-potential/

XRP Price Prediction 2025: Will It Hit $4 While MoonBull Leads Top Cryptos to Buy This Week

Curious about where the digital asset XRP might be headed next and why a fresh contender is turning heads? While XRP trades around $2.45 today with a 24‑hour trading volume of nearly $6.14 billion, buzz around a newer token is picking up fast.

**MoonBull Presale Sparks Excitement**

MoonBull, currently in its live presale with a $0.00008388 entry price at Stage 6, has already raised over $600K and is generating massive excitement among early investors. Its unique governance system allows holders to vote on key project decisions, making every OBU holder an active part of the journey.

This article explores the XRP price prediction for 2025, weighing bulls and bears, and contrasts it with why MoonBull leads among the top cryptos to buy this week.

—

### MoonBull’s Standout Features Lead Among the Top Cryptos to Buy This Week

MoonBull is making waves in the crypto world with its presale now live, sparking serious interest among early investors. At Stage 6, the current price is $0.00008388, meaning a $200 investment at this stage grants approximately 2,384,358 tokens with projected listing earnings of $14,687.65—making this opportunity hard to ignore.

Focused on accessibility, transparency, and long-term growth, MoonBull is positioned as a top crypto to buy this week. Its governance system, starting at Stage 12, gives every OBU holder a direct voice in decisions, with one vote per token and no lock-ups or thresholds. Voting power is tied to wallet balances, enabling the community to steer campaign initiatives, supply burns, features, and incentive reserves. All decisions are transparently shared to align strategy with holders and maintain trust while propelling the project forward.

Built on the Ethereum blockchain using the ERC‑20 standard, MoonBull benefits from deep compatibility with wallets, decentralized exchanges (DEXs), and DeFi platforms. Additionally, leveraging Ethereum’s mature validator network, audit infrastructure, and secure environment supports functions such as reflections, sell taxes, burns, and staking. This integration within Ethereum’s ecosystem ensures broad accessibility and scalability as the crypto world evolves.

—

### XRP Current Price and Recent Market Dynamics

XRP’s current price hovers near $2.45, up approximately 8.99% over the past week. Analysts reference various live price feeds: one chart reports $2.54 with a 24-hour trading volume of around $6.29 billion, while another lists $2.52 with roughly $184 million in 24-hour volume.

In recent months, XRP has repeatedly tested resistance near $3.00, while support levels range between $2.70 and $2.90. The token has demonstrated solid upside potential but also signs of fatigue, as whales and institutional investors closely monitor developments.

—

### XRP Price Forecast: Balancing Bullish Momentum and Downside Risks

XRP’s price outlook is currently shaped by conflicting forces:

– **Bullish Drivers:** The macro environment is improving, with risk‑on sentiment returning amid expectations of potential Federal Reserve rate cuts. Higher futures open interest and growing institutional engagement are providing support for XRP’s live price.

– **Bearish Concerns:** Some technical analysts warn of a potential 50% drop to around $1.25 if key support levels fail. Others suggest that a break below $2.69 could trigger a decline to $2.20. Market sentiment is also heavily influenced by regulatory clarity regarding XRP’s status and ETF flows. If major players pull back, momentum may weaken.

While network upgrades are positive, ecosystem adoption must scale and integrate for sustained growth. Overall, the outlook remains nuanced. XRP has room to climb if positive catalysts align but faces clear risks of correction. Analysts are closely watching the $2.70-$3.00 zone like “cats eyeing a laser pointer.”

—

### XRP Price Prediction for 2025: Targets, Scenarios, and Method

When projecting XRP’s price for 2025, consider three primary scenarios:

– **Bearish Scenario:** If XRP fails to regain $3.00 and broader market weakness sets in, a drop toward approximately $2.20 or even $1.25 is plausible.

– **Base (Neutral) Scenario:** Many forecasts suggest XRP could trade between $2.23 and $2.58 in 2025, with some estimates placing the average near $2.59.

– **Bullish Scenario:** If adoption accelerates, regulations become clearer, and ETF flows materialize, XRP could challenge $4.00 or higher by year-end.

Overall, a reasonable target for XRP in 2025 might fall within the $2.50-$4.00 range, depending on the strength of catalysts. If conditions align optimally, the $3.50-$4.00 zone is achievable, while potential setbacks could keep it between $1.25 and $2.20.

For traders, this means preparing for either a friendly “penguin bounce” or a “peanut-butter slide.”

—

### Why Blockchain Developers and Financial Analysts Should Keep an Eye on XRP

From a developer’s perspective, XRP offers more than price speculation; it provides a payments‑focused ledger with potential for network partnerships.

For financial analysts, its market cap, liquidity, and exchange listings make it a “reasonably large‑cap alt” for modeling. Key variables to monitor include:

– Network integrations

– Institutional money flows

– Regulatory outcomes

– Macro‑economic conditions

The sweet spot occurs when technical patterns, investor sentiment, and network fundamentals align. Large wallet (whale) movements could amplify price action significantly.

For financial students, this offers a live case study in how crypto asset valuation blends technology, law, and investor psychology.

—

### Conclusion

In short, XRP has potential to climb but it’s far from guaranteed. If adoption, regulation, and macro conditions break right, the token could head toward $3.50-$4.00 in 2025. However, if key support levels collapse, downside risks to $1.25-$2.20 exist.

The message for watchers is to stay alert and understand both the “penguin‑glide” and the “peanut‑drop” scenarios.

Meanwhile, MoonBull leads among the top cryptos to buy this week and represents a contrasting tale of early‑stage hype. While XRP might offer a measured ride, MoonBull is capturing speculative momentum, offering a broader view of the evolving crypto landscape.

—

### For More Information

– **Website:** Visit the Official [MOBU Website](#)

– **Telegram:** Join the [MOBU Telegram Channel](#)

– **Twitter:** [Follow MOBU on Twitter](#)

—

### FAQs about Top Cryptos To Buy This Week

**Q: Which is the best crypto to buy now for growth potential?**

A: For speculative upside early in a presale, the OBU crypto presale of MoonBull is attracting interest thanks to its governance system, low entry price, and potential listing gains.

**Q: Which top meme‑oriented crypto offers the highest early‑stage gains?**

A: The OBU crypto presale setup shows high potential ROI for early participants, given the significant price gap between the presale and the possible listing price.

**Q: How can investors secure the next breakout crypto early?**

A: By participating in the MoonBull presale while the stages remain open and prices are low, investors can enter before the listing and broader market awareness.

**Q: Which crypto presale provides the best early‑stage governance exposure?**

A: MoonBull’s governance structure gives every OBU holder voting rights, making it a presale where investors become project architects, not just spectators.

**Q: What’s the risk vs reward of entering a crypto presale now?**

A: Presales like MoonBull’s offer high reward potential but also high risk. Project execution, market conditions, and listing success all matter. Investors should assess carefully and not rely solely on hype.

—

*Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on this information.*

https://blockonomi.com/xrp-price-prediction-2025-will-it-hit-4-while-moonbull-leads-top-cryptos-to-buy-this-week/

Best Crypto To Buy Now: Layer Brett Predicted To Surpass Shiba Inu In 2026 – Layer 2 Testnet Nears

Meme coins are heating up again as traders rotate from big caps into higher-risk plays. Volumes are rising, timelines are full of altcoin charts, and people are hunting for the best crypto to buy now before the next leg of the crypto bull run in 2025.

Amid all this noise, one question keeps coming back: can a new Layer 2 crypto project really challenge Shiba Inu over the next cycle? Right now, many eyes are on Layer Brett (LBRETT), a meme coin building its own Ethereum Layer 2 network. The chain engine and consensus are already live, a public testnet is close, and the site shows real numbers for price, staking, and funds raised.

### Shiba Inu Still Sets the Meme Standard

Shiba Inu proved that memes plus community can move serious value. It turned a simple dog token into a global brand, pulled in millions of holders, and became a daily feature on crypto news feeds.

This shift in demand is why traders now compare every meme project to Shiba Inu on two levels: community and technology. A strong brand like Layer Brett is still important, but people also look at how fast transactions settle, how cheap it is to move tokens, and whether the network can host real products instead of only speculation.

Projects that can offer both culture and working infrastructure are starting to look more attractive to long-term holders who want more than just hype.

### Why Layer Brett Is Catching Up Fast

Layer Brett is rapidly gaining attention as more than just a typical meme token. Unlike many others, it’s building its own Ethereum Layer 2 blockchain for faster transactions, lower fees, and community-driven control.

With its Ethereum-based architecture, seamless interoperability, and advanced technology, LBRETT offers a unique proposition. Currently priced at $0.0058 with a slight increase to $0.0061 looming, Layer Brett has already raised $4,447,892, with staking rewards of 587.02% for early investors.

### Layer Brett Testnet Going Live Soon

The Layer Brett testnet is set to go live soon, marking a major milestone for the project. This testnet launch will allow users to experience the full potential of Ethereum Layer 2 scalability, with low gas fees and faster transactions.

As the network moves toward full Layer 2 functionality, it opens the door for developers to build dApps and other altcoin activities, making LBRETT an even more promising option for the future.

### Conclusion: Could Layer Brett Pass Shiba Inu by 2026?

No one can say for sure which token will win the next cycle, but the direction is clear. Shiba Inu will likely remain a major meme name, yet newer projects are racing to offer faster networks, better staking, and cheaper fees.

For traders building their own “best crypto to buy now” list, Layer Brett stands out as a meme coin that already shows real progress on the network side. If the testnet delivers and more people start using LBRETT, it would not be a surprise to see Layer Brett closing the gap on Shiba Inu by 2026.

—

**For More Information:**

Website: [Insert Website URL]

Telegram: [Insert Telegram Link]

X (formerly Twitter): [Layer Brett (@LayerBrett)](https://x.com/LayerBrett)

https://bitcoinethereumnews.com/crypto/best-crypto-to-buy-now-layer-brett-predicted-to-surpass-shiba-inu-in-2026-layer-2-testnet-nears/

Massachusetts weighs Democrat-backed bill that would scale back climate goals

Massachusetts Lawmaker Warns Climate Targets Are Unlikely to Be Met as Bill Proposes Major Changes

State Representative Cusack told the Commonwealth Beacon, “We’re looking at the real possibility here, in the objective analysis, that we are not going to make our greenhouse reduction mandates. I have not found anyone who says that we are going to make our mandates.” Massachusetts currently aims to slash greenhouse gas emissions in half by 2030, compared to 1990 levels.

However, Cusack’s proposed legislation would change how these targets are approached. Under the bill’s current language, climate targets would no longer be enforceable and instead be considered “advisory in nature.” The commonwealth would also be granted “immunity” if it fails to reach these emissions limits.

Changes to Energy Efficiency Program Funding

A critical component of Cusack’s bill involves capping the budget for the state’s energy efficiency program, Mass Save. The Department of Public Utilities approved Mass Save’s budget at around $4.5 billion in late February of this year. Cusack’s legislation would cap the budget at $4 billion and further reduce it by more than $300 million over three years, ending in 2027. This reduction would specifically target funds dedicated to marketing and advertising initiatives.

Delays in Offshore Wind Development Targets

The bill would also adjust Massachusetts’ timeline for offshore wind energy development. Current law requires the state to contract more than 5 gigawatts of offshore wind by 2027. Cusack’s legislation proposes delaying this deadline until 2029.

Defending the Bill: Challenges from Federal Policies and Rising Energy Costs

Cusack has stated that his intent is not to undermine the state’s climate goals but to reassess short-term mandates in order to lower energy bills and address the effects of federal policies. He mentioned the Trump administration’s opposition to renewable energy, such as its crackdown on offshore wind, the termination of funding for the Solar for All program, the withholding of electric vehicle infrastructure funds, and efforts to phase out clean energy tax credits. According to the bill, these actions threaten jobs, supply chain development, and emissions reduction goals in Massachusetts, while also adding regulatory risk and increasing costs for ratepayers.

“We want to get there, but if we’re going to miss our mandates, and it’s not the fault of ours, it’s incumbent on us not to get sued and not have the ratepayers be on the hook,” Cusack told the Commonwealth Beacon. He did not respond to requests for further comment from the Washington Examiner.

Response from Environmental and Climate Advocates

Cusack’s bill has received backing from many Democrats in the state House and was advanced out of the Joint Committee on Telecommunications, Utilities, and Energy on Wednesday. Despite this support, it has sparked backlash from environmental and climate advocacy groups who warn that the bill would threaten Massachusetts’ clean energy progress. Critics say that funding cuts to Mass Save could ultimately increase energy bills.

In 2024, Mass Save program directors estimated that it generated around $2.8 billion in total benefits for participants, including over 1 million megawatt-hours in electric savings.

Amy Boyd Rabin, vice president of policy for the Environmental League of Massachusetts, told Canary Media, “We want good energy-affordability legislation. This is not that. The claim that climate policies are the thing making prices rise is just not based in fact.”

Next Steps for the Legislation

Cusack aims to bring the bill to a vote in the Massachusetts House by November 19, when lawmakers break for the year. From there, it would need to pass in the state Senate before heading to the governor’s desk. The bill is expected to face challenges, as many legislators have previously supported the very measures the legislation seeks to revise.

https://www.washingtonexaminer.com/news/3887443/massachusetts-weighs-democrat-mark-cusack-backed-bill-scale-back-climate-goals/

Investor Interest in Ozak AI Surges as Presale Nears $5M — Market Analysts Forecast Strong 2026 Performance

**Ozak AI Presale Nears $5 Million as Investor Demand Strengthens**

Ozak AI is quickly becoming one of the most talked-about presale tokens of the quarter, with its presale amount nearing $5 million. The project has sparked significant investor confidence by combining cutting-edge Web3 infrastructure, including DePIN, AI intelligence tools, and tokenized growth.

To help users make better investing decisions, Ozak AI plans to offer automated trading insights and real-time market intelligence. Market analysts suggest that Ozak AI could be well-positioned for substantial growth by 2026, as demand for AI-driven cryptocurrency platforms continues to rise.

—

### Presale Progress and Token Details

The Z token launched its presale earlier this year and is currently in Phase 7, with each token priced at $0.014. So far, the project has raised over $4.56 million and sold more than 1 billion tokens, inching toward the $5 million mark.

Given this momentum, the team plans to increase the token price once again at listing. The target price is $1 per token, which would represent a stunning rally of over 7,000% from the current presale price and an incredible 99,900% increase from the initial $0.001 phase.

A significant factor driving demand is token scarcity: only 30% of the total 10 billion Z token supply is allocated for presale fundraising. This limited availability has attracted early participants eager to capitalize on the project’s growth potential.

—

### Z Token Utility: Powering the Ozak AI Ecosystem

The Z token serves as the primary utility token within the Ozak AI ecosystem, granting users access to exclusive intelligence tools equipped with automated trading features and premium data streams.

Token holders can contribute processing power to the platform’s DePIN infrastructure and stake their Z tokens to earn rewards. Additionally, users can create custom Prediction Agents (PAs), share their insights, and generate passive income in Z tokens.

Higher-tier holders benefit from fee discounts, making the platform more efficient and rewarding for the community.

—

### Strategic Partnerships Strengthen Market Position

Ozak AI has developed multiple strategic partnerships to enhance its technology and ecosystem growth ahead of 2026:

– **Meganet:** Collaboration with Meganet’s node network to improve distributed computing and accelerate data processing.

– **Phala:** Integration of Phala’s full CPU-GPU-TEE stack for more secure AI workflows and shared developer tools.

– **Mira:** Partnership to implement trustless verification systems, boosting AI reliability.

– **Celo:** Cooperation to simplify on-chain payments for AI tools.

– **Dex3:** Joint efforts for advanced market forecasting and automated trading strategies.

These alliances position Ozak AI at the forefront of innovation in AI-powered blockchain platforms.

—

### Conclusion

With its presale rapidly approaching $5 million and partnerships continuing to grow, Ozak AI is gaining increasing trust from investors. Early participants in the current phase could potentially see returns of up to 8,233% if the token reaches its $1 target price.

As the project builds momentum moving into 2026, Ozak AI is poised to become a major player in the convergence of AI, Web3, and decentralized finance.

—

### For More Information About Ozak AI, Visit the Links Below:

– **Website:** [Insert Website URL]

– **Twitter/X:** [Insert Twitter/X URL]

– **Telegram:** [Insert Telegram URL]

—

*Youtube embed: Ozak AI Z Token: Crypto Whales Predict and Compare it with Ripple (XRP)*

https://bitcoinethereumnews.com/tech/investor-interest-in-ozak-ai-surges-as-presale-nears-5m-market-analysts-forecast-strong-2026-performance/

Napa Valley College’s $7.5 million solar field was once a model. Now it sits dead in the weeds

It was April 2006, and the mood was celebratory at Napa Valley College. A crowd had assembled to toast the school’s new solar field—5,600 photovoltaic panels arranged in neat rows across 5 acres of floodplain the school said couldn’t be used for much else beyond hay cultivation.

Solar installations are ubiquitous now, appearing on desert plains, winery properties, and carports. In 2006, they looked like the future. Rep. Mike Thompson addressed the onlookers that day, calling the project “a model and inspiration.” Then two students flipped a symbolic power switch, marking what was seen as the beginning of a new energy era for the campus.

At the time, the photovoltaic array was the fifth largest in the United States. The system could generate about 1.2 megawatts of power—roughly 40% of the campus’ electricity needs—with panels that automatically pivoted with the sun. Officials estimated it would shave about $300,000 a year from PG&E bills.

Napa Valley College (NVC) proudly featured the solar field on the cover of its 2005-06 Report to the Community. Accolades followed. A Korean TV crew came to film a segment in spring 2007, and the 2007-08 Napa County Grand Jury report commended the college for the solar installation as well as a new cooling system that worked by circulating chilled liquid, saying both could serve as national models for reducing emissions.

Some reports predicted a 25-year lifespan for the system. Others said 30. But roughly 15 years after that ribbon-cutting moment, the panels went dark. They now sit idle and overgrown with weeds.

### What happened to Napa Valley College’s $7.5 million solar field?

The answer points to a public institution unable to keep pace with a rapidly evolving industry and offers a cautionary tale for other energy innovators navigating the turbulent world of solar power.

—

### The Early Years

The project began with Measure N, a $133.8 million bond approved by voters in November 2002 to upgrade campus infrastructure, including a new library, performing arts center, and life sciences building. Among its goals: the installation of a photovoltaic system to reduce the school’s reliance on utility power.

By 2005, NVC had hired Berkeley-based solar energy company PowerLight to design and build the system at a cost of $7.5 million—$4 million from Measure N bond funds and $3.5 million from PG&E incentives. It was a full turnkey project, with PowerLight handling the engineering, procurement, and construction, then selling the completed system outright to the college once it was commissioned. Installation was completed the following year.

“*There may be like 100 people who understand this stuff. Napa Valley College is not in the 100,*” said Gopal Shanker, founder of Napa-based Récolte Energy.

In its proposal, PowerLight—which at the time called itself the most experienced solar system supplier—said the solar farm would save the college $9.1 million over 25 years and require “virtually no maintenance.” It offered a 25-year warranty on the panels.

Within a year, in January 2007, PowerLight was acquired by Silicon Valley-based solar panel manufacturer SunPower Corp., which inherited the project’s annual inspections and maintenance duties. For a while, everything seemed to work smoothly.

A 2013 college report on Measure N projects showed the array producing the promised 40% of campus electricity, cutting carbon emissions by about 600 tons per year. Then performance began to slip.

By 2017, output had fallen to about one-third of the campus’s needs, according to a facilities master plan from that year. Maintenance costs climbed as the system aged.

In 2018, SunPower discovered a fault in the wiring and charged the college $160,000 for repairs. By late that year, a report listed the array’s “useful life” as nearly expired, and administrators floated the idea of relocating it to rooftops or parking lots to free up the land.

—

### The Switch to Fuel Cells

As PG&E rates rose and solar output fell, the college sought other solutions. In August 2020, it entered into an agreement with San Jose-based Bloom Energy to install a fuel cell on campus.

The system runs on natural gas but converts it through a chemical reaction that’s more efficient and less polluting than burning fuel in a conventional generator. Installed in early 2021, the fuel cell was expected to save the college more than $3 million over 15 years. Bloom would own, operate, and maintain it, while the college paid for the energy it produced.

NVC spokesperson Jenna Sanders said the solar panels were decommissioned when the fuel cell came online because they had started leaking, posing a fire hazard. When the college sought repairs, she said, the company responsible for maintenance—SunPower—had gone out of business and was unavailable.

“The solar field was deactivated at some point and has not provided any electrical support to the campus in recent years,” she said. But Sanders offered no additional details, and without a clear timeline from the college or alignment between recent statements and older board records, it remains difficult to determine exactly when the panels were taken offline.

In a recording of the August 2020 board meeting, as then-assistant superintendent Bob Parker presented the fuel cell proposal for approval, he told the college’s board of trustees the solar field was still producing some of the campus’s daytime power. The fuel cell, he said, would augment the electricity produced by the solar field, not replace it.

Sanders said the college does not have information on the performance of the solar panels at that time. Up until February 2021, the college was making payments to SunPower for maintenance of the solar panels, documents show. Soon after that, they appear to have been deactivated.

Trustee Jason Kishineff said he doesn’t recall any discussion of the solar array since joining the board four years ago. Asked by The Press Democrat about the system’s performance and any records on its decommissioning, college officials said they had no information to share.

While a 2016 maintenance contract with SunPower promises annual performance reports, a public records request for any such documents did not yield any results.

—

### SunPower’s Fall and the College’s Loss

The college’s timeline regarding SunPower doesn’t seem to match the public record. The company spun off its manufacturing division in 2019 but continued operating its commercial and industrial installation units through early 2022, according to published reports. It didn’t file for bankruptcy until August 2024.

By 2022, Napa Valley College was trying to recover costs linked to the failing array, but those efforts fizzled.

“We ran into a buzz saw,” Assistant Superintendent James Reeves said at a district facilities committee meeting in March 2025. “They (SunPower) went bankrupt and now they’ve been dissolved.”

College representatives did not respond to questions about whether the school sought insurance coverage, warranty compensation, or reimbursement for the project’s losses.

After SunPower’s bankruptcy, another company, Complete Solar, acquired its brand and trademarks. The new company directs former SunPower customers seeking service or warranty help to outside lenders, leaving many—including Napa Valley College—without clear recourse.

—

### The ‘Solar Coaster’

In retrospect, it’s hard not to view Napa Valley College’s solar project as a failure. Yet some energy experts say the idea itself had merit.

“I quite like projects like the one you describe in Napa,” said Omer Karaduman, Center Fellow at the Stanford Institute for Economic Policy Research and at the Precourt Institute for Energy. “There are a lot of efficiencies you get by scaling the size of panels. Over around 1 megawatt, the scale works quite well. Without knowing the specifics of the project, I would say it sounds like a reasonable investment.”

And NVC isn’t the only public entity that struggled to adapt to problems that emerged in the solar industry, said Gopal Shanker, founder of Napa-based Récolte Energy and a renewable energy consultant for more than 20 years. He described a sector defined by shifting incentives, frequent bankruptcies, and layers of bureaucratic complexity from PG&E to the California Public Utilities Commission.

Industry insiders have a name for that volatility: “the solar coaster.”

“There may be like 100 people who understand this stuff,” Shanker said. “Napa Valley College is not in the 100. They have other things to do with their time. They’re trying to educate kids.”

He pointed to his work with Napa Valley Unified School District. The manufacturer that supplied the solar modules for district projects between 2010 and 2017—a Chinese company called Suntech Power—went out of business. So did the firm that made Napa Valley Unified’s inverters. And so did all three of the solar installers that built those systems.

“The burden of trying to figure out what all this means is falling on the person in charge of facilities, who in the middle of a meeting I’m having with him gets a call saying there’s an ant infestation in a classroom, and he’s got to run to solve that problem,” Shanker said.

The constant churn of technology and policy only adds to the chaos, he said.

“While we are developing a project, every morning I wake up and have to think, ‘OK, where have the goalposts moved today?’ Because the rules change while you are playing the game.”

When Napa Valley College installed its solar field, Shanker said, large arrays typically relied on powerful central inverters that controlled the entire system. Those inverters began failing after about a decade and have largely been replaced industry-wide by networks of smaller “string” or “micro” inverters.

As for the promised 25- to 30-year lifespans? Shanker said those projections became an industry mantra, repeated so often they were accepted as fact—even though they were “pulled out of thin air” by a solar module manufacturer in the late 1990s and early 2000s and not based on real data.

Karaduman agreed. While a 25- to 30-year lifespan has become the industry norm today, he said, that expectation wasn’t realistic in 2006.

“How long did they last? 10 to 15 years?” Karaduman said of the NVC panels. “I would say that’s pretty good.”

—

### The Road Ahead

More than a year ago, the college began exploring a new campus-wide solar project. San Francisco-based solar energy company ForeFront Power proposed two systems: a 2.7-megawatt array for the main campus and a 442-kilowatt version for the college’s River Trail Village housing complex.

At an August 2024 meeting, physics professor Joshua Murillo praised the college’s intent to reduce fossil fuel use but asked whether the original solar project met its goals and, if it didn’t, whether the barriers it faced were being addressed in the new proposal.

“As someone concerned with the long-term impact of fossil fuel usage, I fully support efforts to reduce our reliance on them,” he said. “However, as a taxpayer, I also want to ensure that the college is assessing these projects with due diligence.”

In the months that followed, administrators determined the Bloom Energy fuel cell already offset much of the school’s electricity costs. A change in PG&E regulations meant customers could export electricity to the grid from only one on-site power source. As a result, the college withdrew from its contract with ForeFront for the main campus.

ForeFront had also offered in January to dismantle the old solar array for about $1 million, but the college balked.

“Eventually, we’ll do an open bid to demolish it,” Reeves said in March. “I think it may have some salvage value. I’d like to get rid of it as much as anybody but for a million dollars, we have to take a closer look.”

The college still plans to salvage the panels but has no firm schedule.

Today, the panels no longer follow the sun. They stand motionless as grass and weeds grow high around them near the Napa Valley Vine Trail—rusting reminders of a dead project.

The college did not provide information about ongoing maintenance expenses or liability insurance coverage. More recently, officials said a consultant involved in the early years of the project has offered to help redesign it to export energy again. The college has just begun exploring this option.

Meanwhile, the college is also considering another bond measure to fund future construction and infrastructure—more than two decades after voters approved the one that built the first solar field.

Despite the original system’s failure to live up to its promise, at least one expert thinks Napa Valley College should consider returning to solar power. Panel costs have fallen about 90% since 2006, said Karaduman, the Stanford Institute fellow, while electricity rates continue to rise. The technology has also become far more efficient—enough that the college could generate three or four times as much power from the same 5 acres. And with advances in battery storage, NVC could now use the energy it produces instead of navigating strict regulations on exporting it to the grid.

“Building a solar field from scratch is hard,” Karaduman said. “You have to get permits and do all this due diligence. But since you already have a field there, and you have connection to me, this sounds like a no-brainer investment.”

https://www.mercurynews.com/2025/11/14/napa-valley-colleges-7-5-million-solar-field-was-once-a-model-now-it-sits-dead-in-the-weeds/