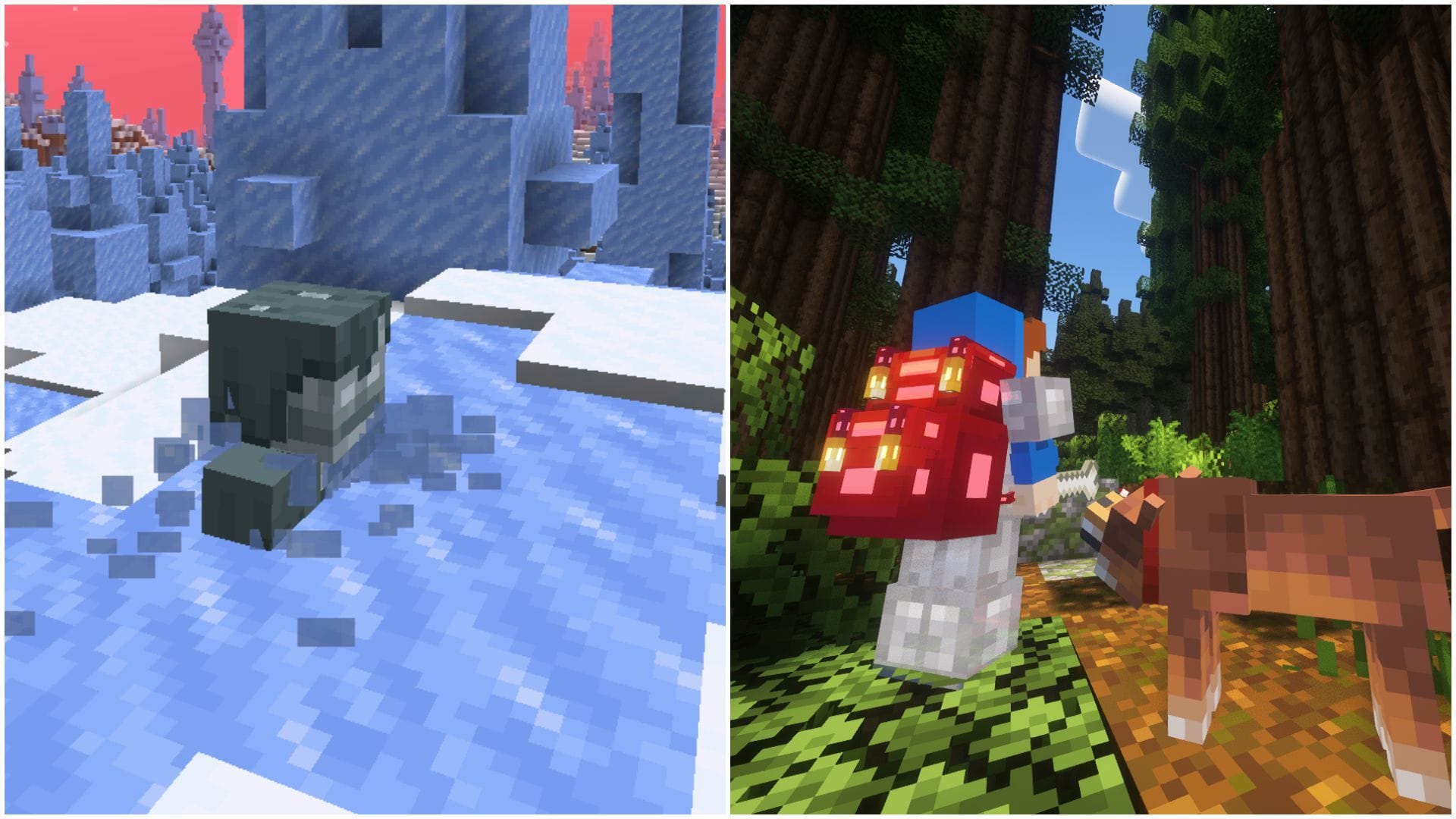

Minecraft datapacks are similar to mods that can change the game’s behavior using vanilla data like JSON, command functions, etc. There are loads of datapacks for Mojang’s sandbox that players can download. While some of them add brand-new in-game features, most are about improving the quality of life. Here are some of the best quality-of-life datapacks worth checking out for Minecraft. Note: This article is subjective and solely reflects the writer’s opinion. 5 great quality-of-life datapacks for Minecraft 1) Veinminer On several occasions, players might find several ore blocks adjacent to one another, even though they are not large iron or copper veins that form in Minecraft. These smaller veins of iron, copper, coal, etc., can be fun to mine away. However, if players want to save time and mine the entire small vein at once, they can check out the Veinminer datapack. This datapack adds the ability to mine the entire cluster of ores at once. Players simply need to mine one ore block, and others will automatically break and drop resources. 2) Spawn animations Spawn Animations, as the name clearly suggests, is a datapack that adds brand new spawning animations to hostile mobs specifically. With this datapack, hostile creatures like zombies, skeletons, spiders, creepers, endermen, slimes, etc., spawn by coming out of the ground like shown in the picture above. This makes their spawning a lot more realistic, as they do not simply pop up in the world out of thin air. 3) Dynamic Lights When players hold any light block in vanilla Minecraft, they will not be able to light up a dark cave or a mine. The only way to light up an area is by placing the light block in the world. Similarly, if a light block is dropped as an item on the ground, it will not emit any light in the world. If players use mods like OptiFine or any shaders, they support dynamic lighting. However, if players only want a vanilla experience with dynamic lighting, they can use the Dynamic Lights datapack. 4) Backpacks! Backpacks! is another brilliant quality-of-life datapack that simply adds backpacks to craft and use in Minecraft. A simple backpack can be crafted using eight leather and one chest, while an ender backpack can be crafted using an ender chest. These backpacks can also be upgraded on the smithing table using an additional chest and iron, diamond, or netherite. They can also be dyed to any color on the smithing table. They are great for carrying extra items while on an exploration trip, especially early in the game when players might not have shulker boxes. 5) Better Trees Better Trees is a world generation datapack that greatly enhances tree generation. As the picture above clearly shows, this datapack adds new tree generation mechanics. Each tree from different biomes has a unique generation system, making them unique. This datapack also works well with tree mods like Tectonic, Falling Trees, etc. Check out our latest article on Minecraft: 5 best Very Cool x Minecraft collab merchandise fans would love How to open pie chart in Minecraft Java Edition This Minecraft survival island seed is perfect for speedrunners This Minecraft survival island seed works for both Bedrock and Java.

https://www.sportskeeda.com/minecraft/5-best-quality-of-life-minecraft-datapacks

Category Archives: general

Legacy of Mayor Marilyn Hatley

On Thursday, November 20, 2025, the City of North Myrtle Beach honored Mayor Marilyn Hatley for nearly three decades of devoted leadership at the forefront of the City of North Myrtle Beach. “We are deeply grateful to have been guided by such a strong, visionary woman-both on City Council and as our Mayor.” “Her strength, compassion and unwavering commitment have shaped North Myrtle Beach for the better, creating a lasting impact on residents and visitors alike.” “Mayor Hatley, thank you for 29 years of exceptional service.” “City legacy projects she has played important roles in”: “Beach Preservation: Mayor Marilyn Hatley created a pivotal movement when it came to making the North Strand beaches healthy and beautiful. She also served and was the leading pioneer behind the South Carolina Beach Advocates, along with Mayor Goodwin in Folly Beach, South Carolina.” “North Myrtle Beach Park and Sports Complex: Mayor Hatley also played a massive role in helping to advocate for an expansion to the Park and Sports Complex. The city dedicated $36 million toward the first part of the expansion, including six new baseball/softball fields and multipurpose fields (soccer, lacrosse, etc.).” “North Myrtle Beach Aquatic and Fitness Center: Mayor Hatley was the movement behind creating the notable Aquatic and Fitness Center in North Myrtle Beach. She fought relentlessly to make the Fitness Center what it is today, and was also a leading part of the expansion that will be taking place in 2026. She cared for members, residents and those looking to move to the city to have something for everyone to stay fit and healthy.” “Robert Edge Parkway Bridge: A vital connection that improved and eased traffic in North Myrtle Beach is another one of Mayor Hatley’s greatest legacy accomplishments. This is considered one of the busiest in North Myrtle Beach, with a 2023 South Carolina Department of Transportation study showing the daily count at 44, 900 vehicles a day.”.

https://www.nmbtimes.com/legacy-of-mayor-marilyn-hatley/

Brothers in elbows: Gophers’ Cade Tyson, Nuggets’ Hunter Tyson

To place an obituary, please include the information from the obituary checklist below in an email to obits@pioneerpress. com. There is no option to place them through our website at this time. Feel free to contact our obituary desk at 651-228-5263 with any questions. General Information: Your full name, Address (City, State, Zip Code), Phone number, And an alternate phone number (if any) Obituary Specification: Name of Deceased, Obituary Text, A photo in a JPEG or PDF file is preferable, TIF and other files are accepted, we will contact you if there are any issues with the photo. Ad Run dates There is a discount for running more than one day, but this must be scheduled on the first run date to apply. If a photo is used, it must be used for both days for the discount to apply, contact us for more information. Policies: Verification of Death: In order to publish obituaries a name and phone number of funeral home/cremation society is required. We must contact the funeral home/cremation society handling the arrangements during their business hours to verify the death. If the body of the deceased has been donated to the University of Minnesota Anatomy Bequest Program, or a similar program, their phone number is required for verification. Please allow enough time to contact them especially during their limited weekend hours. A death certificate is also acceptable for this purpose but only one of these two options are necessary. Guestbook and Outside Websites: We are not allowed to reference other media sources with a guestbook or an obituary placed elsewhere when placing an obituary in print and online. We may place a website for a funeral home or a family email for contact instead; contact us with any questions regarding this matter. Obituary Process: Once your submission is completed, we will fax or email a proof for review prior to publication in the newspaper. This proof includes price and days the notice is scheduled to appear. Please review the proof carefully. We must be notified of errors or changes before the notice appears in the Pioneer Press based on each day’s deadlines. After publication, we will not be responsible for errors that may occur after final proofing. Online: Changes to an online obituary can be handled through the obituary desk. Call us with further questions. Payment Procedure: Pre-payment is required for all obituary notices prior to publication by the deadline specified below in our deadline schedule. Please call 651-228-5263 with your payment information after you have received the proof and approved its contents. Credit Card: Payment accepted by phone only due to PCI (Payment Card Industry) regulations EFT: Check by phone. Please provide your routing number and account number. Rates: The minimum charge is $162 for the first 12 lines. Every line after the first 12 is $12. If the ad is under 12 lines it will be charged the minimum rate of $162. Obituaries including more than 40 lines will receive a 7. 5% discount per line. On a second run date, receive a 20% discount off both the first and second placement. Place three obituaries and the third placement will be free of charge. Each photo published is $125 per day. For example: 2 photos in the paper on 2 days would be 4 photo charges at $500. Deadlines: Please follow deadline times to ensure your obituary is published on the day requested. Hours Deadline (no exceptions) Ad Photos MEMORIAM (NON-OBITUARY) REQUEST Unlike an obituary, Memoriam submissions are remembrances of a loved one who has passed. The rates for a memoriam differ from obituaries. Please call or email us for more memoriam information Please call 651-228-5280 for more information. HOURS: Monday Friday 8: 00AM 5: 00PM (CLOSED WEEKENDS and HOLIDAYS) Please submit your memoriam ad to memoriams@pioneerpress. com or call 651-228-5280. Cade and Hunter Tyson, a pair of 6-foot-7 brothers, have reached some impressive heights on a wide variety of basketball courts. Cade is having a strong start to his senior season with the Gophers men’s basketball team; the transfer wing leads the Big Ten Conference in scoring through six games. His older brother Hunter surged in his last year at Clemson and became a second-round pick in the 2023 NBA draft; the small forward now comes off the bench for the Denver Nuggets. Yet a piece of both wishes they were just kids again, playing one-on-one in North Carolina. Their first hoop was nothing more than iron rim fastened to a five-foot wooden post stuck out in their grass yard. No frills, not even a backboard. “Very Carolina of us,” Hunter recalled. When in elementary school, the boys, along with their sister Laikyn, received a quality half-court set-up, complete with glass backboard and a big, flat concrete slab. At the time, it was a world-class court. “I wish I could get that time back,” Cade told the Pioneer Press while on his new home court, Williams Arena, in October. “Looking back, I miss those days, man,” Hunter said before a Timberwolves-Nuggets game at Target Center in November. While they fondly look back on their youth, it sounded like combat training. “Fouling the heck out of each other,” Hunter recalled. Their father Jonathan served as referee. Well, sort of. “I would use that terminology lightly,” he said in an interview. “I would just keep them from hurting each other. I would let them pretty much go at it.” Through the fog of time, Cade, who is three years younger, remembers it being a bit more one-sided. “My brother liked to throw some elbows in the paint a little bit,” he said. “. But looking back, it made me tougher.” Cade has needed that durability. When Hunter was getting his first taste as an NBA rookie in 2023-24, Cade was riding high in his sophomore season at Belmont, shooting 46% from 3-point range and averaging 16. 2 points a game. With a big frame and smooth shooting stroke, Cade was highly ranked target in the NCAA transfer portal that spring and picked traditional powerhouse North Carolina. Growing up south of Charlotte in the town of Monroe, Hunter was a Tar Heels fan, while Cade said he didn’t have a “dream school.” UNC did have an influence on him, however, as a family photo shows Cade decked out in Carolina blue while playing on that concrete slab. But last season in Chapel Hill was a struggle for Cade: He played only eight minutes per game, 29% from deep and averaged 2. 6 points across 31 contests. “We tried to keep him from getting discouraged,” Jonathan said. “There were times where he was discouraged. I mean, I’d be lying if I didn’t say we were all discouraged.” But Jonathan tried to remind Cade of what he could control, showing up to work every day. One message: “The biggest thing you need to understand is (UNC guard) Seth Trimble is one of the best defenders in the country. You’re practicing against him every single day. You need to develop your offensive game.” Cade hit the transfer portal again and landed at Minnesota. While it’s only a small sample size, his 21. 3 points-per-game average sits No. 1 in the Big Ten and 14th in the nation going into games Wednesday night. He is showing signs of being a three-way scorer: from behind the arc, at the rim and from the foul line. Tyson can continue to build on that hot start when Minnesota (4-2) plays Stanford (4-1) in the Acrisure Series at 8: 30 p. m. Thursday in Palm Desert, Calif. Gophers head coach Niko Medved knows what a competitive household looks like; he had two younger brothers while growing up in Roseville. “It’s wanting to beat your brothers more than anything,” Medved said. “I think for Cade, being in those (younger brother) shoes really, really helped him grow. Cade has an unbelievable work ethic and he’s very competitive, but he’s also got great discipline.” The Gophers honored Tyson for scoring 1, 000 career points before the 7 p. m. tipoff against Chicago State on Nov. 18, and Tyson showed his commitment by being one of the first players onto The Barn court before 5 p. m. “He obviously built great habits growing up,” Medved said. “His dad was a coach. His brother was a terrific player. It’s been in his blood and in his culture. I think so many of those habits have been ingrained in him. He’s just so fun to coach every day.” Jonathan Tyson played at Wingate and his coaching career led to plenty of gym access for his kids. They also attended a variety of games, from high school to college and to the Charlotte Hornets. But letting ’em play on that variety of courts was primarily about having them “figure it out. Developing the competitive spirit was really the big idea.” Jonathan now serves as the Chief of School Performance for the Union County Public Schools, a district with 53 schools and 41, 000 students. He also wanted his children, including high school volleyball player Laikyn, to gain the nuances of sports. “Soft skills that they could learn, being a good teammate, working with others, by being competitive, by practicing and preparing to be your personal best,” Jonathan said. The NBA was not the goal for his sons. They also played baseball growing up and didn’t start playing hoops on the traveling circuit at young ages. “I was just hoping (Hunter would) get an opportunity to go to college,” Jonathan said. “And to be quite candid, help us financially, so he could go to college (on scholarship), so neither he nor I nor our family would be in a great deal of debt.” When Cade struggled at UNC last season, his NBA older bro was there to help. “It was a tough year for him last year, but (it was) the way he worked super hard this summer,” Hunter said. “Last year, (I was) just trying to encourage him. He always kept his faith and kept working hard and just knew it was a short storm that he would eventually get out of.” Mother Torri said her boys were competitive off the court, too, including in the Chutes and Ladders board game. But while Jonathan was “definitely pretty tough” on the boys, Torri would be there to “remind them of the softer side.” “We are so blessed,” Torri said. “It’s not just all the success that you see, but all the stuff people don’t see. The ugliness of social media can be pretty hard, so seeing them overcome that in the mental aspect of the game. That is what I’m more proud of.” Pioneer Press reporter Jace Frederick contributed to this story.

https://www.twincities.com/2025/11/26/nuggets-hunter-tyson-helps-bother-cade-tyson/

Panola County Jail Log

This list was taken from the log at the Panola County Jail. A name listed does not indicate that a person is guilty of the crime with which they are charged, only that the person has been taken to, and processed at, the facility. Nov. 17 Sandra Ruth Cauthen, 128 Patton Lane, Batesville, charged with contempt of court. Nov. 18 Tamarcus Dewayne Patterson, 221 Claremont St., Sardis, arrested on a bench warrant (grand larceny). Elizabeth Nicole Lemaire, 1365 Fitzgerald Blvd., Tunica Resort, charged with contempt of court. Cassandra Dawn Scruggs, 229 Hays St., Batesville, charged with felony embezzlement. Shucannon Ladurious Jones, 118 Hoskins Rd., Batesville, charged with felony possession of stolen property. Anthony Albert Sims, Sr., 281 Saddle Creek Dr., Oxford, held for court. Dandre Deshawn Ashby, 175 Crystal Lane, Batesville, charged with simple domestic violence. Nov. 19 Roger Desi Comer, 591 Hwy. 310, Como, charged with possession of a controlled substance, possession of paraphernalia, and no insurance. James Wesley King, 3369 Henderson Rd., Batesville, charged with simple domestic violence. Trenterius Dontray Bell, 111 Oakleigh Dr., Batesville, charged with DUI (other). Tyler Jaquentin Presley, 189 Rayburn Rd., Como, arrested on a bench warrant. Rodrickqus Danyelle Henderson, 706 Jones St., Crenshaw, charged with public drunkenness and contempt of court. Michael Anthony Slaughter, 15621 Hwy. 315, Sardis, charged with DUI and expired tag. Eddie Wayne Ray, 109 Danny Lane, Sardis, charged with no insurance, expired tag, improper equipment, failure to stop, and disorderly conduct. Mkayla Alicee Johnson, 1225 Shiloh Rd., Courtland, charged with simple assault. Jeffery Earl Taylor, 60 Ruby Rd., Courtland, charged with disturbance of the peace. Brittany Shawlala Flowers, 206 Tubbs Rd., Batesville, charged with simple assault and disturbance of the peace. Nov. 20 Tammy Jean Steward, 4073 Hwy. 310 Crenshaw, charged with possession of a controlled substance, possession of paraphernalia, and contempt of court. Nov. 21 Joderi Jamal Reeves, 3130 Madewell St., Memphis, charged with possession of paraphernalia and felony fleeing. Samarse Shonrell Toliver, 319 Greenhill Circle, Sardis, charged with possession of paraphernalia. Alisa Monique Petty, 232 Van Voris St., Batesville, charged with harassment and trespassing. Nov. 22 Lyndon Mosley, Jr., 405 Sanders Rd., Sardis, charged with contempt of court. Elias Trantham, 8264 Park Pike Dr., Southaven, charged with DUI. Tracy Willard Tigner, 704 Chapel Hill, Pope, charged with DUI. Nov. 23 Jakayla Raychell Flowers, 2 00 Fisher St., Batesville, charged with contempt of court, malicious mischief, and shoplifting.

https://panolian.com/2025/11/26/panola-county-jail-log-152/

Algona Nativity scene commemorates 80th anniversary

It’s Christmas season and for Marv Chickering, chairperson of the Nativity Scene*, it’s the busiest time of the year. He has his sign-up list ready for himself and ninety-seven volunteers from the Algona First United Methodist Church to sign up for two-hour shifts to welcome guests to view this extraordinary scene. Marv has volunteered countless hours over the years managing [.] The post Algona Nativity scene commemorates 80th anniversary first appeared on Enterprise Media.

https://www.charlescitypress.com/articles/news-kossuth/algona-nativity-scene-commemorates-80th-anniversary/

Stock Movers: Nvidia, Dell, Hewlett Packard Enterprise (Podcast)

Homes at or under $500,000 in Carbon County, Nov. 17 to 23

Prospective homebuyers considering the real estate market had a range of options in various neighborhoods throughout the region between Nov. 17 and Nov. 23. In this article, we outline recent property sales in Carbon County, all of which featured homes under $500,000. Below, we provide an overview of the top five properties in each area, chosen for their proximity to the desired price range and the largest living spaces. Please note that the properties in the list below are for real estate sales where the title was recorded during the week of Nov. 17, even if the property may have been sold earlier. 1. $495K, 4 bedrooms / 3 bathrooms Situated at 470 Innsbruck Drive, this single-family residence, consisting of four bedrooms and three bathrooms, was sold in October for a price of $495, 000, translating to $202 per square foot. The property, constructed in 1992, offers a living area of 2, 448 square feet and sits on a 1. 0-acre lot. The deal was finalized on Oct. 31. 2. $438K, 3 bedrooms / 2 baths At $438, 000 ($315 per square foot), the townhouse at 73 Warbler Court offered another opportunity below the targeted price range when it changed hands in October. This property, built in 1983, provides 1, 390 square feet of living space, featuring three bedrooms and two baths, and sits on a 784-square-foot lot. The deal was finalized on Oct. 29. 3. $425K, 3 bedrooms / 1 bath For a price tag of $425, 000, the detached house, built in 1972 and at 40 Birch Street changed hands in November. The home spans 884 square feet of living area, with three bedrooms and one bath. The property comprises a 0. 5-acre lot. The deal was finalized on Nov. 5. 4. $375K, 4 bedrooms / 3 bathrooms In November, a single-family home, with four bedrooms and three bathrooms, at 191 Winding Way, changed ownership. The property, covering 2, 826 square feet, was built in 2002 and was sold for $375, 000, which calculates to $133 per square foot. The lot size encompasses 1. 0 acre. The deal was finalized on Nov. 3. 5. $350K, 3 bedrooms / 2 bathrooms This single-family house, featuring three bedrooms and two bathrooms, underwent a change of ownership in November. At 947 Coal Street, the home spans 2, 059 square feet and was sold for $350, 000, or $170 per square foot. The property sits on a lot measuring 0. 3 acres, and it was built in 1969. The deal was finalized on Nov. 4.

https://www.lehighvalleylive.com/realestate-news/2025/11/homes-at-or-under-500000-in-carbon-county-nov-17-to-23.html

Thanksgiving turkey recipe 2025: Cook your bird in under an hour

By Tan Vinh, The Seattle Times SEATTLE Teriyaki chicken is a quick and cheap lunch that’s synonymous with Seattle. One acclaimed local chef, Taichi Kitamura of Eastlake’s Sushi Kappo Tamura, makes a compelling case for elevating that humble poultry dish into a fancy Thanksgiving feast. Teriyaki chicken is only made with dark meat. That rule also applies to turkey teriyaki, since the breast meat will dry out, the chef said. Kitamura offered us a pan-fried turkey breast recipe, too, with a sake-and-butter sauce. He typically fries the turkey breast while the rest of the meat roasts in the oven. All told, the entire turkey was cooked and ready to be eaten in less than an hour. We asked for both recipes and printed them below. Enjoy! Thanksgiving turkey teriyaki Ingredients 2 turkey thighs, deboned 2 turkey wings 2 cups soy sauce 2 cups sake 1 1/4 cups sugar 2 cups water 2 cups hot water 1/3 cup of whiskey (optional) Steps 1. Break down the turkey by chopping it down the middle, cutting off the hindquarters (thighs and drumsticks) and separating the thighs from the drumsticks. 2. Turn the bird over and cut off the breast from the rib cage and then chop the wings that are attached to the breasts. (A turkey has the same anatomy as a chicken, so if you’re more of a visual learner, head to YouTube for step-by-step instructions on breaking down a bird.) 3. Then comes the deboning. Detach the bone by trimming the edge of the meat where it meets the bone. The rest is less labor-intensive. (No need to debone the wings, since they cook faster.) 4. Score the meat with the tip of the knife. 5. For the marinade: In a large mixing bowl, add the hot water and sugar; whisk until all the sugar is dissolved. 6. Add soy sauce, sake, whiskey and water. Let the teriyaki sauce cool before marinating the meat. 7. Marinate the turkey for 12-16 hours in fridge. 8. On Thanksgiving Day, remove the turkey from the marinade. Towel it dry. 9. Lay the meat on a flat rack/grid over a pan, skin side up. A rack or grid over the pan helps keep the turkey from getting soggy from all the fat drippings. The rack helps crisp up the skin, too. 10. Roast the turkey in an oven (preferably a convection oven) preheated to 475 degrees until the temperature of the thickest part of the meat reaches 165 degrees. If using a conventional oven, heat the oven to 450 degrees. 11. Depending on the size of your turkey and your oven, you may need to use two trays or cook in batches. 12. Cut into 3/4-inch slices and serve. Pan-fried turkey breast Ingredients 2 turkey breasts, deboned 1/3 cup vegetable oil 1 stick of butter, cut into 8 pieces 1 1/4 cups sake 1/2 cup soy sauce Salt and black pepper to taste 3 bay leaves 2 tablespoons lemon juice Steps 1. Butterfly the breast meat to an even width of about an inch thick or less. 2. Score the skin with the tip of the knife. 3. Season with salt and pepper. 4. In a large frying pan or skillet, heat vegetable oil. 5. Place the turkey skin side down on medium-high heat, cooking until the skin is golden-brown. 6. The turkey will be too large to cook on one skillet, so cook each breast separately or use two skillets. 7. Turn the turkey and cook the meat until the internal temperature reaches 165 degrees. Remove from the pan. 8. Deglaze the pan with sake. Add the bay leaves, soy sauce, lemon juice and butter. Add the juice from the cooked turkey if there is any. Stir vigorously with a spoon to emulsify. 9. Cut the turkey into 3/4-inch strips. Place on a platter. 10. Pour the sauce over the turkey and serve. ©2025 The Seattle Times. Visit seattletimes. com.

https://www.marinij.com/2025/11/26/thanksgiving-turkey-under-an-hour/

Take AI seriously, or else

If there’s ever a time to get on the artificial intelligence (AI) hype train, that time is now. That’s the message that one emerging technologies expert is sending companies all over the world. As a former executive of both Facebook (NASDAQ: META) and SpaceX, Dex Hunter-Torricke has seen countless technologies rise and fall. And in his keynote address at the 10th Digital Conference (DigiCon) held in the Philippines, Hunter-Torricke explained that the last two decades in human history were transformed by the vast increase in access to software and analytics. Now, he says the age of AI has arrived, and there’s a steep price to pay for those who are too slow to adopt the technology. “Any company that doesn’t take AI seriously won’t exist 10 years from now,” Hunter-Torricke told reporters at DigiCon 2025. “Fundamentally, they can either get on board the train, or they’ll get run over by it.” Of course, AI technology is far from perfect. There’s a whole laundry list of limitations that humans must contend with just to use existing AI tools properly. These include reliance on possibly flawed data, the inability to engage in ethical decision-making, and a lack of genuine common sense and awareness, among others. However, developers are already working to address these limitations, and the world may soon see a level of AI that has only ever been seen in movies before. The rise of Artificial General Intelligence The goal for AI has always been to achieve human-level intelligence, now commonly referred to as Artificial General Intelligence (AGI). And apparently, it’s no longer a matter of “if” but “when” this will happen. Hunter-Torricke says there is considerable debate about the expected timeline, but it may occur soon. “Most folks reckon we are less than a decade away,” he said. “We might be as close as three or four years, so it’s coming very quickly.” Factor in extra time to scale AGI technology, and this is expected to radically transform business all around the world. Having machines that can function on the same level cognitively as people would change workflows even more drastically than what is happening today, and this is expected to become both a boon and a challenge for societies globally. Hunter-Torricke himself has a slightly cynical outlook on just how the world will be able to handle such a technology: Back to the top ↑ The ethical challenges of AI It seems that more than most other modern technologies, AI poses massive ethical challenges. After all, when you have something as powerful as AI, you can create massive change for the better or for worse, depending on just how you use the technology. Content creation, for example, is one area that Hunter-Torricke believes can be significantly transformed by AI. Specifically, the technology can affect the pace at which content is generated, in turn making it faster and easier to strategize and reshape the way people think. “Are you using those technologies in ways that respect local culture, that reflect the right value systems that are working for clients who are going to deliver good for societies?” the former Facebook and SpaceX executive asked. These, he said, are challenges that industries are already struggling with right now, especially when there are people who do not care enough to meet the highest ethical standards. “In a future where you will just be able to scale and operate and build your business much faster with much greater global effects, doing the wrong things means you’ll be able to do the wrong thing a hundred times greater at a faster scale,” Hunter-Torricke explained. He added that this is genuinely very challenging for companies and for societies. Back to the top ↑ An important moment While it is impossible to predict precisely how AI will develop in the coming years, one thing that the world agrees on is that the technology will be a game-changer. Companies that are too slow to adopt AI risk lagging behind their competitors, and may even be dominated in their industry. Slowly but surely, AI is making its way into the everyday lives of the general public, and its continuous rise seems all but inevitable at this point. What remains to be seen is how companies will respond and who will ultimately emerge as the leader in the AI arms race. “There’s never been a more important moment as a CEO, I think, to pay attention to what is happening technologically,” he said. In order for artificial intelligence (AI) to work right within the law and thrive in the face of growing challenges, it needs to integrate an enterprise blockchain system that ensures data input quality and ownership-allowing it to keep data safe while also guaranteeing the immutability of data. Check out CoinGeek’s coverage on this emerging tech to learn more why Enterprise blockchain will be the backbone of AI. Back to the top ↑ Watch | DigiCon 2025: The power of personalization in Digital Marketing.

https://bitcoinethereumnews.com/tech/take-ai-seriously-or-else/