**InsightAce Analytic Pvt. Ltd. Announces Release of Market Assessment Report on Global Cryogenic Equipment Market**

InsightAce Analytic Pvt. Ltd. has announced the release of a comprehensive market assessment report titled:

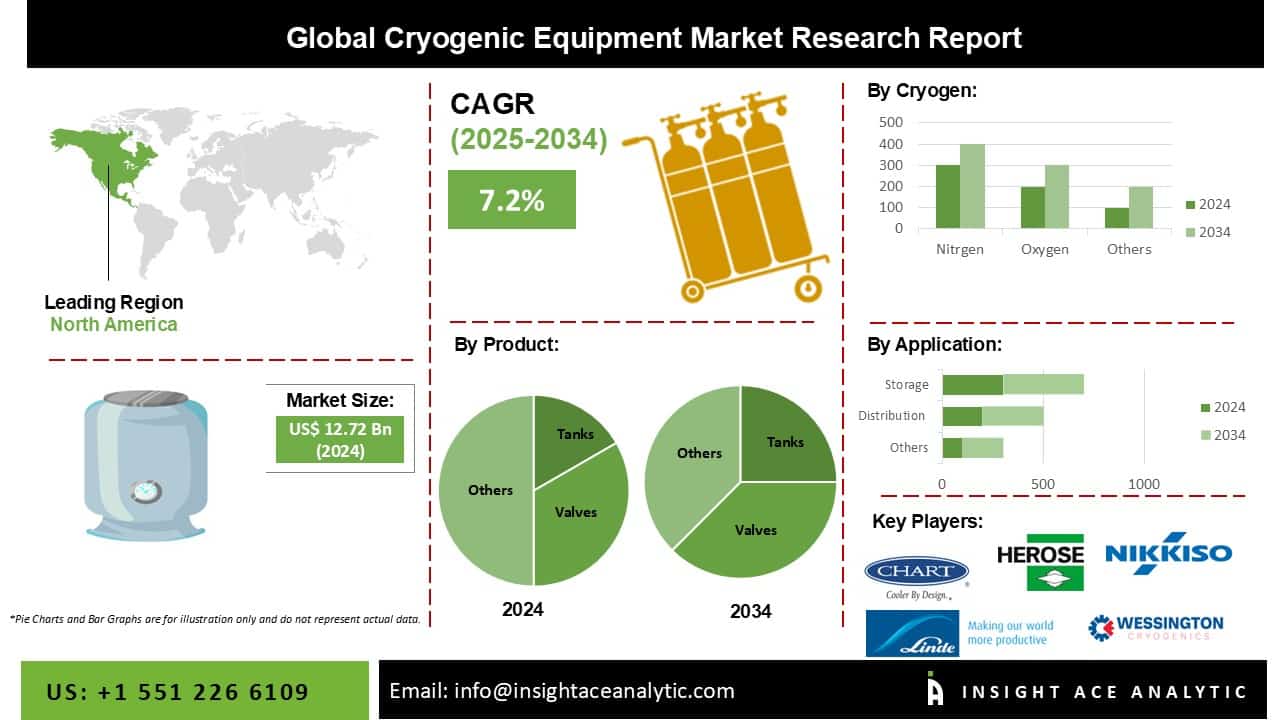

**“Global Cryogenic Equipment Market Size, Share & Trends Analysis Report By Product (Tanks, Valves, Pumps & Vaporizers, Vacuum Jacket Piping (VJP)), By Cryogen (Nitrogen, Oxygen, Argon, And Liquefied Natural Gas), By Application (Distribution And Storage), By End-Use (Oil & Gas, Metallurgy, Automotive, Food & Beverage, And Chemical) – Market Outlook And Industry Analysis 2034.”**

The global cryogenic equipment market is estimated to reach over **USD 25.25 billion by 2034**, exhibiting a **CAGR of 7.2%** during the forecast period.

—

### Overview of Cryogenic Equipment

Cryogenic equipment is utilized to facilitate the production and handling of substances at extremely low temperatures. This equipment finds applications across various sectors, including:

– Storage and transportation of liquefied gases

– Food preservation

– Cryosurgery

– Superconducting electromagnets

Increasing investments in liquefied natural gas (LNG) power plants aimed at generating sustainable energy are anticipated to drive greater adoption of cryogenic systems.

The rising integration of renewable energy sources into infrastructure has amplified the need for efficient energy storage solutions across industries. Cryogenic Energy Storage (CES) is expected to play a pivotal role in this context, particularly when paired with renewable power generation, thereby propelling global demand for cryogenic technologies.

**Request For Free Sample Pages**

—

### List of Prominent Players in the Cryogenic Equipment Market

– Air Liquide S.A.

– Air Products Inc.

– Abhijit Enterprises

– Beijing Tianhai Industry

– Braunschweiger Flammenfilter GmbH

– Chart Industries Inc.

– Cryofab Inc.

– Cryogas Equipment

– Cryogenic Liquide

– Cryolor SA

– Cryoquip LLC

– Cryostar

– Emerson Electric

– Graham Partners

– Fives

– Flowserve Corporation

– Galileo Technologies S.A.

– Herose GmbH

– INOX India Ltd., INOXCVA

– IWI Cryogenic Vaporization Systems (India)

– Lapesa Grupo Empresarial s.l

– Linde Group AG

– MAN Energy Solutions SE

– Nikkiso Co. Ltd.

– Oswal Industries Limited

– Oxford Instruments

– PACKO Industry

– Parker Hannifin

– Premier Cryogenics Ltd.

– SAS Cryo Pur

– Schlumberger Limited

– Shell-n-Tube

– SHI Cryogenics Group

– Sinocleansky

– Standex International

– Super Cryogenic Systems

– The Weir Group PLC

– Ulvac Technologies, Inc.

– Vacker LLC

– VRV SPA

– Wessington Cryogenics

—

### Market Dynamics

#### Drivers

The increasing demand for renewable energy is expected to significantly drive the growth of the cryogenic equipment market in the coming years. Applications involving the transportation, storage, and regasification of gases for clean energy generation present considerable opportunities for market expansion.

Additionally, the growth of the healthcare sector in emerging economies and substantial investments in the metallurgical, chemical, and petrochemical industries are anticipated to support increased adoption of cryogenic systems.

#### Challenges

Cryogenic equipment typically consists of stainless-steel components, including pressure containment tubes and static support shafts. However, substituting these stainless-steel elements with advanced glass/epoxy composite materials could enhance system efficiency.

Despite this potential, the market faces constraints such as:

– Stringent regulations aimed at reducing hazardous greenhouse gas (GHG) emissions from the steel industry

– Price volatility caused by fluctuating crude oil supply and demand

—

### Regional Trends

– **Asia Pacific:** The Asia Pacific region is projected to dominate the cryogenic equipment market in terms of revenue. This is supported by shifting consumer behaviors, favorable government policies promoting sustainable development, and substantial investments in industrial infrastructure. The increasing energy demand in the region, combined with a growing emphasis on renewable power sources, is driving the deployment of gas-fired power plants.

– **North America:** Particularly in the United States and Canada, the LNG export sector holds significant potential. With the gradual decline in coal availability, LNG-powered plants are gaining traction, creating promising opportunities for cryogenic equipment. The expected rise in gas demand, especially in industrial and power generation sectors, will further propel regional market expansion.

—

### Recent Developments

In June 2021, TECO 2030 and Chart Industries, Inc. signed a Memorandum of Understanding (MoU) to collaborate on the development of technological solutions to capture and store carbon dioxide (CO2) emitted by ships.

The deal outlines a three-year joint development plan to create onboard carbon capture systems for ships using Cryogenic Carbon Capture (CCC) technology developed by SES, which Chart acquired in December 2020.

—

### Segmentation of Cryogenic Equipment Market

**By Product:**

– Tanks

– Valves

– Pumps & Vaporizers

– Vacuum Jacket Piping (VJP)

– Others

**By Gas:**

– Nitrogen

– Oxygen

– Argon

– Liquefied Natural Gas (LNG)

– Others

**By Application:**

– Distribution

– Storage

**By End-Use:**

– Oil & Gas

– Metallurgy

– Automotive

– Food & Beverage

– Chemical

– Other

**By Region:**

– **North America:** US, Canada, Mexico

– **Europe:** Germany, UK, France, Italy, Spain, Rest of Europe

– **Asia-Pacific:** China, Japan, India, South Korea, Southeast Asia, Rest of Asia Pacific

– **Latin America:** Brazil, Argentina, Rest of Latin America

– **Middle East & Africa:** GCC Countries, South Africa, Rest of the Middle East and Africa

—

### About InsightAce Analytic Pvt. Ltd.

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions help identify market needs and competitive factors to expand businesses successfully.

We assist clients in gaining a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products.

Our expertise lies in providing syndicated and custom market intelligence reports with in-depth analysis and key market insights delivered in a timely and cost-effective manner.

—

### Contact Us

– **Email:** info@insightaceanalytic.com

– **Website:** [www.insightaceanalytic.com](http://www.insightaceanalytic.com)

– **Phone:** +1 607 400-7072 (USA) | +91 79 72967118 (Asia)

Follow us on social media: [Twitter](https://twitter.com/InsightAce)

—

*Curious about this latest version of the report? Get in touch to learn more or request your free sample pages today!*

https://www.prnewsreleaser.com/news/115880